We were thrilled to take part in such a well-thought out piece on marketplaces, and a fintech's place in such an exciting, dynamic ecosystem.

Here's a look at some of what we contributed to the piece:

Open Banking as an approach to payments is maturing. Payment Initiation Services (PIS) enable providers to initiate payments and financial transactions by account to account payments. This results in lower costs and increased speed of the transfer of funds. Accounting Information Services (AIS) gives the user a consolidated view of their data and allows providers to know more about the business.

Open banking reduces friction in payments via PIS but it’s AIS that offers the valuable access to data. tomato pay is an open banking provider that offers PIS and AIS. Using a solution like tomato pay gives marketplaces an opportunity to become a distinctive platform for businesses. As Anna Tsyupko, COO for tomato pay, says “PIS is the hook for AIS – once a business has understood the benefits of PIS, such as a fairer and more cost-effective solution, they are more likely to sign up for AIS.”

Once their sellers sign up for open banking, the marketplace has the data they need to be able to offer loans or tailored finance. Or they can direct the seller to other products when they know it might be needed, even if those products exist on other marketplaces. The marketplace that has access to such enriched data has the potential to become the seller’s marketplace of choice, the main player in an ecosystem of verticalised marketplaces.

You can find the full paper here.

About tomato pay

Community has never been as important as it is today, and watching the business and sole trader community struggle throughout the past year has spurred us on to take a more community-led approach to our business.

tomato pay is a simple, QR-code based payments and invoice app powered by Open Banking and built on our tomato pay API platform which offers both AIS and PIS capabilities.

Businesses and sole traders can benefit from our low-cost QR-code payments solution with no hidden fees, which saves them money compared to their current payment systems, gives them instant access to their money as cash settlement happens almost immediately, and access to all of their bank accounts in one place.

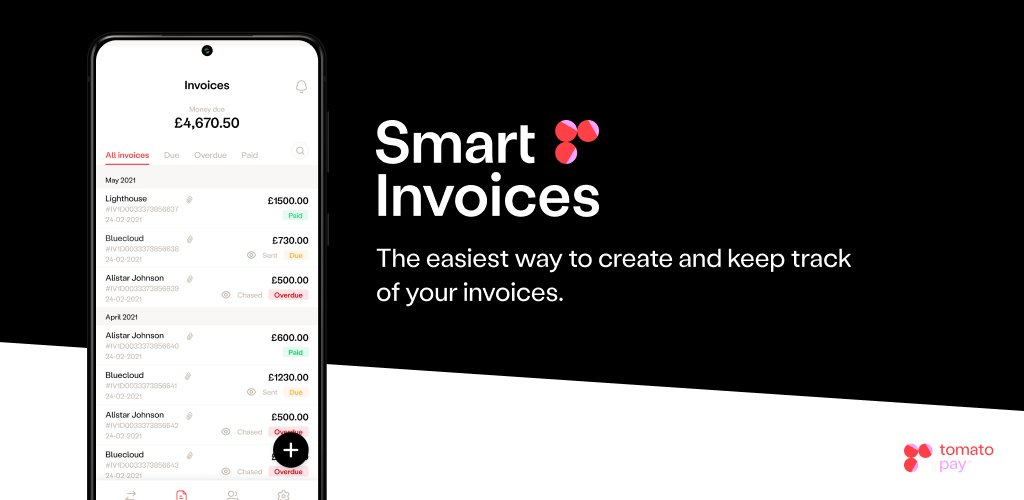

Businesses and sole traders can benefit from our quick and easy invoice solution. Invoices can be created within the app, with the option to give discounts and late penalties (pre-built into the app using gamification and behavioural science) and send nudges to remind customers and clients to pay. Plus, as you connect your bank account, payments are embedded within the app - so no need to give your bank details, and receive money owed instantly into your account.

Everyone can support their local communities thrive by paying their neighbourhood businesses in a cashless, hassle-free way. Join the waitlist. Make sure to join in on the discussion over at our community page!

tomato pay is an FCA-regulated authorised Account Information & Payment Initiation Service Providers (AIPISP) provider. You can find us on the Open Banking Directory, and on the FCA registered list here.