Happy first birthday, Open Banking!

Today, you are one year older and wiser - and so are we.

Still, in its infancy, the groundbreaking Open Banking (PSD2) legislation was enforced on the 13th January 2018.

Over the past twelve months, Open Banking, which required banks to open up their APIs to fintechs, has garnered significant interest worldwide - and for good reason.

Their ambitious goal to open up competition within the small business banking sector to new fintechs (challenger banks, insights platforms, comparison tools), and to make these fintechs more accessible, was followed closely by everyone in the UK and beyond.

So, what progress has been made so far?

Small businesses now have a wider variety of tools to better manage their cash

According to the 2018 FIS Performance Against Customer Expectations (PACE) report, one in four small businesses are expected to change their provider over the next twelve months, as their needs are not being met by their current bank.

For decades, traditional banks have had the stronghold in both the retail and small business banking sector, leaving little room for competition and improvement. According to Bloomberg, ‘Politicians in the U.K., where four banks control 75 per cent of deposits, were particularly keen on the law’s (PSD2/ Open Banking) goal of encouraging new entrants’.

Fintechs, (including us, here at tomato pay) were thrilled when the Open Banking legislation passed. In less than twelve months, fintechs faced fewer hurdles (that’s not to say there weren’t a significant amount of issues to overcome in the first place) when competing and partnering with traditional banks, giving choice-starved small business owners a wider variety of tools to better understand and manage their cash.

Data has become more accessible, which will help make the finance industry more inclusive.

Data has become a valuable commodity over the past few years.

Small businesses will benefit greatly from sharing their banking data with fintechs, who are eager to make finance more inclusive through a better banking experience.

Small business owners can now give permission-based access to their banking data with a variety of financial platforms. In return they can get insightful, useful, and more intuned tools to help them check their cash flow, save money or compare eligibility for various financial products. As a result, they can save time (which might have been spent on deciphering their business’ finances and applying for loans that didn’t necessarily suit their unique business needs) and have a better understanding of their cash flow.

The global financial industry has taken notice

The UK fintech scene flourished this year, whether they were partnering with banks or announcing standalone solutions to improve the small business banking experience.

Many countries from around the world have seen this, and have taken their cues for Open Banking best practices from the UK to achieve something similar. As Open Banking Trustee, Imran Gulamhuseinwala OBE previously told us: “I’ve travelled across many countries to talk about our Standards – Canada, Australia, Hong Kong, Singapore to name but a few – and one thing we are all crystal clear on is the importance of ownership of data. We are way past data belonging to a financial institution – it belongs to the customer. Data is valuable – and it’s time for customers to reap the benefits from this, with confidence. It’s early stages for data portability – but we expect to see the debate, and indeed the delivery, of data portability to increase exponentially.

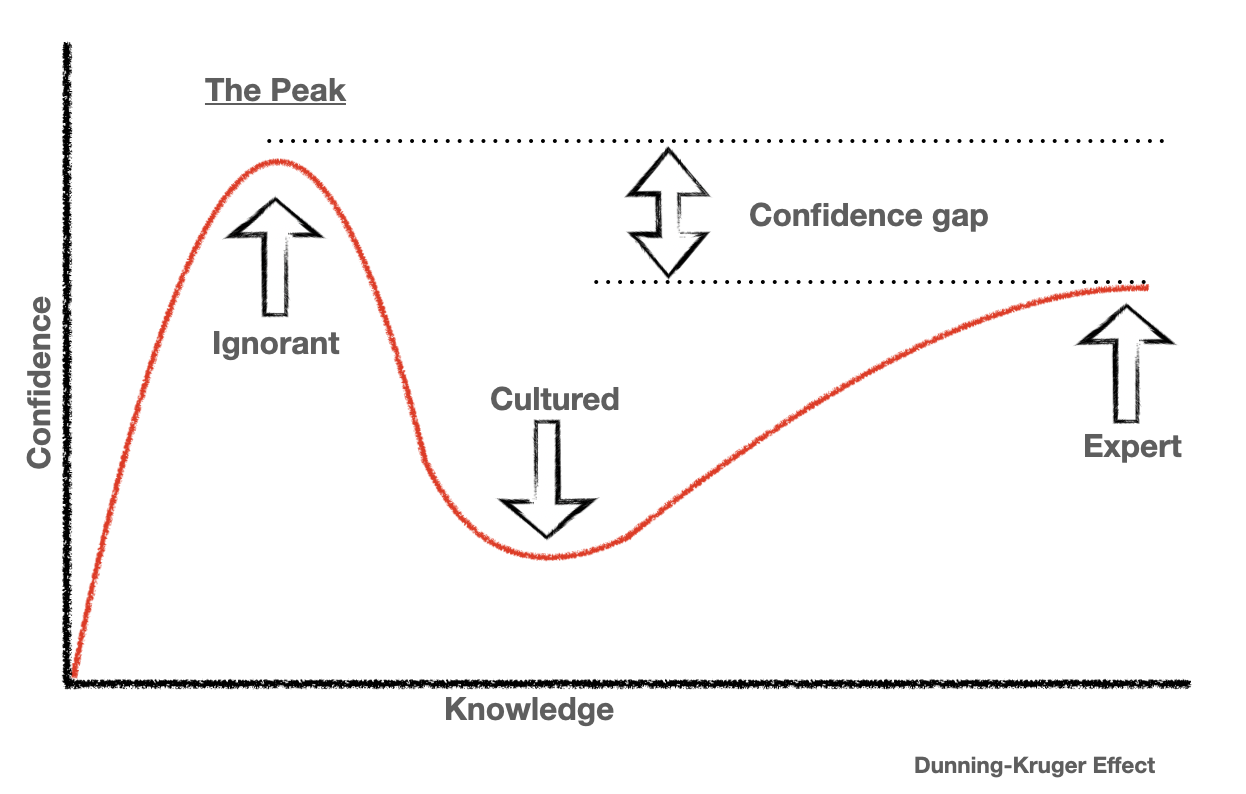

It is still early days, and although there are those saying that they haven’t seen the banking revolution happen just yet, it’s hard for us to look at it so short-term, and to be honest - take such an unfair approach to it. Nothing worthwhile was built in a day, and we shouldn’t expect the fintech revolution to happen as quickly either.

Here at tomato pay, we remain very optimistic about Open Banking.

Better access to data means that we can give small businesses a financial product that they will love and enhance their day-to-day work. The same mentality most likely applies to many fintechs here in the UK.

If fintechs and banks can improve on their small business offering because data access has opened up, then it is already a huge step in the right direction for everyone involved.