Supporting the ever-changing SME landscape requires willingness to change too.

tomato pay (previously Fractal Labs) CEO and founder Nicholas Heller talks about his ongoing mission to support ‘underserved’ SMEs and sole traders, and how a shift to a more ‘community led’ brand incentivising the action of ‘spending locally’ combined with the impacts of the pandemic has influenced a decision to refocus and rebrand. You can see the op-ed in Fintech Futures.

SMEs and sole traders account for 99.9% of all UK businesses, yet there are very few financial products and services created specifically to meet their needs.

In terms of funding, SMEs are stuck in the middle between retail banking and corporate financing. With payments, SMEs and sole traders accept the costly fees and long settlement times that come with handling money as there are so few options; we all know that it shouldn’t be like this.

Access to funds whether it is money earned, or money borrowed should not be as difficult as it is today for businesses who contribute £2.3trillion to the UK economy.

With consumers, banks make their money from lending, and with large corporates, there is profit to be made thanks to the huge values. However, due to an SME’s small values and sometimes quite specific needs, banks often don’t invest in creating products and services with these businesses in mind.

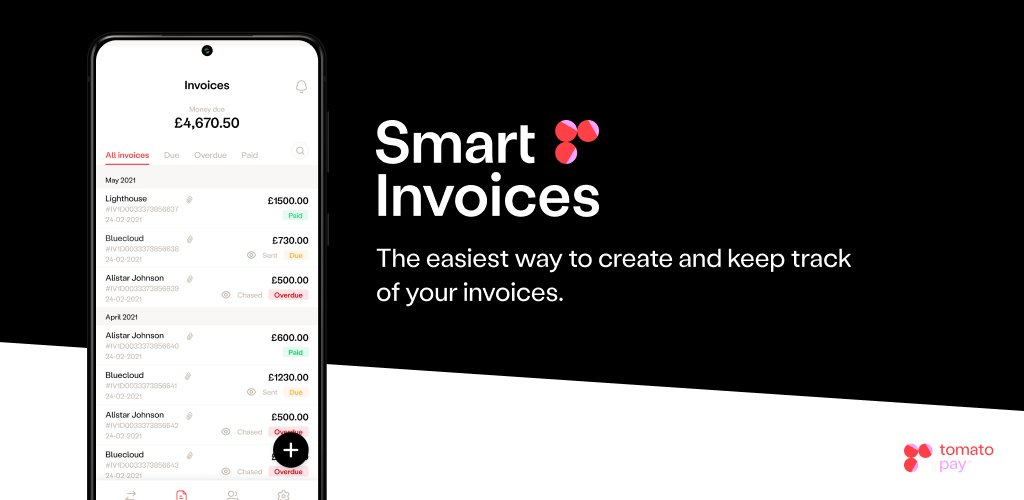

It is the same with payments. Big businesses have big transaction volumes and therefore can justify dedicated payment and invoicing software, but there isn’t the same offering that caters to the needs of SMEs whose volumes are small - yet being able to collect payments quickly, efficiently and cost-effectively is vital to their survival.

SMEs need better support to allow them to continue to play their vital role in our economy which is why in 2014, we set up Fractal Labs to help SMEs manage their cash flow. Over the years, this evolved into an offering for financial institutions who have a relationship with the majority of UK SMEs. Our API suite was built for financial institutions and corporates so that they could build products that would better serve their SME customers. This included aggregating banking, accounting and other essential datasets to give SMEs a more complete view of all their financial data, as well as cash flow forecasting, and of course, payments.

While SMEs still need financial products and services created specifically for them, the landscape has changed dramatically, which means the way we need to support them has changed too.

Pre-pandemic, we were already beginning to see people shift away from big brands and towards smaller businesses offering local services and products. Combine this with the devastating impact of Covid-19 on SMEs, society’s desire to shop local and support communities has never been stronger.

However, while consumers may want to support local businesses, they still expect convenience and may well be put off if a business is not set up to accept non-cash payments. In turn, business customers may find it more difficult to pay SMEs that don’t have automatic invoicing software in place, leading to late payment and cash flow issues. According to the FSB, SMEs in the UK are owed a collective £23.4 billion; 62% have suffered from an increase in late payments as a result of the pandemic.

This presents all sorts of issues for SMEs who cannot justify the cost of payment technology. They don’t want to lose customers by not having the latest payment and invoicing options, and don’t want to put too much pressure on customers to pay through fear of jeopardising the business relationship. Yet, by not having the right structure in place, they are risking the very survival of their business. According to the FSB, 37% of SMEs have run into cash flow difficulties as a result of late payments, 30% have been forced to use an overdraft and 20% have seen a slowdown in profit growth. Sadly, around 50,000 businesses close every year due to late payments.

More than three quarters of SMEs have no employees, which means the vast majority are sole traders who have set up a business doing something they love. They don’t care for the business admin required to do banking and accounting. They just want to be paid quickly and easily and offer their customers a good service so they can get on with what they’re good at.

The last 12 months have been really tough for small businesses. So many of whom have had to either shut down, or vastly reduce their services as a result of the pandemic. The last thing they need now is to have to worry about admin and cash flow - and yet this takes up huge amounts of headspace, causing massive stress.

Last year, together with untied, we won a £2.5 million bid from the Banking Competition Remedies (BCR) Capability and Innovation fund to improve the financial products and services available to small businesses. We are using the money to help SMEs easily invoice customers, track and incentivise payment through discount and penalties.

Our new payments and invoicing app solution is a key part of our business strategy and our new name - tomato pay. This branding reflects our focus on supporting SMEs and their customers directly, in a community-led way. We want to help them do business, not banking.

SMEs are a key part of our economy, but more importantly, our communities, and we all need to help them get back on their feet and support their continued growth. Ensuring they have the means to get paid quickly, easily and fairly, and have access to funds when they need it. Going forward, tomato pay will be there to support them on their journey.

Sources:

- SMEs account for 99.9% of the business population - 6.0 million businesses

- 1.4 million of these had employees and 4.6 million had no employees.

- Total employment in SMEs was 16.8 million (61% of the total), whilst turnover was estimated at £2.3 trillion (52%).

https://www.fsb.org.uk/resources-page/late-payments-and-what-you-can-do-about-them.html

.png)