tomato pay CEO, Nicholas Heller provides an overview of how FinTech is now impacting small-medium-enterprises through the innovative use of data

Reuters speaking engagement in London from March 2016.

Speakers

- Nicholas Heller, CEO and Co Founder, tomato pay (formerly known as Fractal)

- Richard Kemp, Founder, Kemp It Law

- Helen Ginter, Innovation, strategy and competition division, FCA (Financial Conduct Authority)

Software is Eating the World (of Finance)

Martin Chavez, Goldman Sachs Chief Information Officer at Global Tech Conference in Las Vegas, February 2016.

“Software is eating the world.. (of finance). The easiest illustration is... how many traders we have. At the peak in 2000 we had 600 US Equity Traders working for Goldman Sachs, and now we have 4. We now have 10,000 engineers of which 1,500 of them are quants, and in total about 1/3 of the firm works in technology"

Historical Context: Banking and Financial Services

Banks and Financial Services has historically been one of the business sectors most resistant to disruption by technology.

Since the first mortgage was issued in England in the 11th century, banks have built robust businesses with significant barriers to entry. They have expansive distribution through networks of retail branches, and expertise in areas such as credit underwriting. They also have a near monopoly on the regulated supply credit, which is the lifeblood of economic growth.

Consumer inertia in financial services is also very high. Consumers have generally been slow to change financial services providers.

In recent decades, banks were also helped by deregulation and the maturing of the wealthy baby boomer demographic. In the period between 1984 and 2007, U.S. banks posted a healthy average Return on Equity (ROE) of 13%.

The resilience of incumbent banks was clearly demonstrated throughout the 8year period between the Netscape IPO in 1995 and the acquisition of PayPal by eBay 2002. Over this period, more than 450 digital disrupters attempted to challenge the banks. In 2015, fewer than 5 of these businesses survive as standalone entities.

Banks in 2016

Remain systematically important to the economy;

- Are highly regulated institutions;

- Hold a near monopoly on credit, issuance and risk-taking;

- Are the major repository for deposits, a service which customers largely identify as their primary financial relationship;

- Continue to be the gateways to the world’s largest payment systems, and;

- Still attract the majority of requests for credit.

Yet, some things have begun to change:

- The great recession in 2008 had a negative impact on consumer trust in the banking system;

- The ubiquity of mobile devices has begun to erode the advantages of the physical retail distribution outlooks previously considered a banking necessity;

- There has been near ubiquitous increase in the availability of data, coupled with a significant decrease in the cost of computing power.

Drivers of Disruption

According to a McKinsey report from April of last year, there were approximately 800 FinTech startups globally, but now that number stands at more than 2,000.

What exactly is FinTech? In its broadest sense, Ernst & Young (EY) defines FinTech as high-growth organisations combining innovative business models and technology to enable, enhance and disrupt financial services. This definition is not restricted to startups or new entrants, but includes scale-ups, maturing companies and even non-financial services companies, such as telecommunication providers and commerce players.

Globally, nearly £17 billion of venture capital and growth equity has been deployed to FinTech over the last 5 years, and this number is growing quickly; £9 billion was deployed in 2014 alone.

EY estimates that the UK FinTech sector represented £6.6 billion in revenue in 2015 and attracted £524m in investment. 61,000 people are employed in the sector, representing 5% of the total financial services workforce. Much of the recent success of the UK’s FinTech sector can be attributed to a well-functioning ecosystem, including:

- Access Strong Talent >> the availability of technically, financial service and entrepreneurially minded people. For example, London is now considered one of the capitals of Artificial Intelligence.

- Available Capital >> as mentioned, the availability of capital in the UK for startups and scale-ups has grown significantly.

- Sound Policy >> government policy across regulation, tax and sector growth initiatives have been well received by the market.

- Market Demand >> end client demand across consumers, corporates and financial institutions is high.

FinTech players have a significant opportunity for customer disintermediation. But what exactly are these FinTech players trying to disrupt? It’s worth quickly reviewing the banking business model.

FinTech businesses are mostly threatening five major retail banking areas, including:

- Consumer Finance

- Mortgages

- SME Lending

- Retail Payments

- Wealth Management

Origination and sales, which account for ~60% of global banking profits, is often the focus of FinTech disruptors. It is said that these threads could put at risk about ~40% or £1.1 trillion of global banking revenues by 2025.

FinTech Models

E&Y presents a structural model for FinTech companies, using the acronym ‘CLASSIC’ and explained below with some examples.

C: Customer-centric

- Simple, easy to use, high convenience products and services.

- “Needs focused” propositions designed around consumer use cases and pain points.

- Example: iZettle > a mobile PoS payment solution, making it very easy for users to pay for goods with their mobile devices.

L: Legacy free

- Purpose built systems designed around digital channels and fulfilment.

- Little drag from discontinued products, prior acquisitions or regulatory liabilities.

- Example: Transferwise > an international money transfer business charging low fees. If you want to send money from the UK to Switzerland, they find pools of money in each market, and therefore the transfer happens locally, saving costs.

A: Asset light

- Businesses with a low fixed asset base, creating significant operating leverage.

- Where the balance sheets are frequently outsourced to other parties.

- Example: CrowdCube > a marketplace for equity financing, matching buyers and sellers, hence they are not financing off of their balance sheet.

S: Scalable

- Scalable business models, leveraging partnerships, distribution and simplicity.

- FinTech businesses often have low capital requirements.

- Example: Yoyo > integrated marketing tools for retailers to reach targeted customer segments, drive sales, increase revenue and offer an elevated customer experience.

S: Simple

- Fundamentally simple, focused and transparent businesses.

- Often focused on specific segments, including: Millennials , Small businesses, Underbanked

- Example: iwoca > instant working capital for small-medium-sized enterprises in need of a cash injection.

I: Innovative

- Innovative business models, products and services and delivery models.

- Example: Property Partners > real estate focused investment marketplace. Individuals can invest micro-amounts in real estate to capitalise on London’s booming market.

C: Compliance light

- Simple and unbundled models that are often designed to avoid the need for authorisation.

- Coinfloor > full service for corporate and institutional clients looking to buy, sell or trade bitcoins.

Data Access is the Driver

It is an enabling factor that is critical to the rapid growth of FinTech. Besides the ability to more easily acquire data through the web, there are several regulatory initiatives in the UK that could make a dramatic impact.

Mandatory SME lending referrals

Initiatives such as mandatory referrals of rejected SME loan applicants by banks will drive greater access to alternative finance providers. This initiative was announced in the Budget in March 2014 and is due to go live in 2016.

Open Bank API Framework

This initiative allows consumers and SMEs to access their bank data via APIs. It has the potential to unlock an incredible amount of innovation and pent up demand for new services.

This initiative will need to be completed ahead of the revised Payments Services Directive (PSD2) in 2018/19. Imagine an explosion of apps similar to what happened in the Apple app store or on the Google Play marketplace but this time happening at your bank!

Regulatory Sandbox

The Financial Conduct Authority has announced a ‘regulatory sandbox’, aiming to create a ‘safe space’ in which businesses can test innovative products, services, business models and delivery mechanisms in a live environment without immediately incurring all the normal regulatory consequences of engaging in the activity in question.

Impact on Small Medium Enterprises

SMEs are a major, yet often overlooked driver of the world economy. They account for more than half of the world’s gross domestic product (GDP) and employ almost two-thirds of the global workforce.

Driven by the consumer adoption of technology, there is now the propensity for SMEs to embrace FinTech solutions. In a recent study, US-based small businesses were found to be the greatest users of online business software. In 2015, 51% were using cloud software, closely followed by the UK at 47%.

For example, cloud based accounting solutions such as Xero have taken significant share of the market away from incumbent players such as Sage. The top reasons for leveraging the cloud are security and lower IT costs.

As a result, FinTech embodies a new set of products tailored to the needs of small businesses.

Traditionally, SMEs financing is characterised by high complexity, yet low scale and low profitability.

For traditional lenders such as banks, extending credit to small businesses is often too costly, given the small size of the loan. The global financial crisis of 2008, coupled with higher regulation and the increased capital costs for SME lending, has made it even more difficult for SMEs to secure financing.

IFC data says 45 -55% of SMEs worldwide do not have a loan overdraft, but would need one. While 21 -24% have a loan, they are still financially constrained. Globally, another £1.71 trillion in demand for SME credit exists.

In the UK, the funding gap for SMEs is estimated to be up to £59bn. Based on a recent government-initiated survey, about 30% of British SMEs did not obtain the funding they had tried to obtain.

But it’s not all grim. There are players addressing this market need. Growth in the SME lending is nearly exclusively captured by challenger banks and alternative finance providers.

Types of SME lending being addressed by FinTech players include:

- Marketplace (peer-to-peer) lending >> EG. Funding Circle

- Merchant and e-commerce finance >> EG. Amazon

- Invoice finance >> EG. MarketInvoice

- Supply chain finance >> EG. Taulia

- Trade finance >> EG. Tradeshift

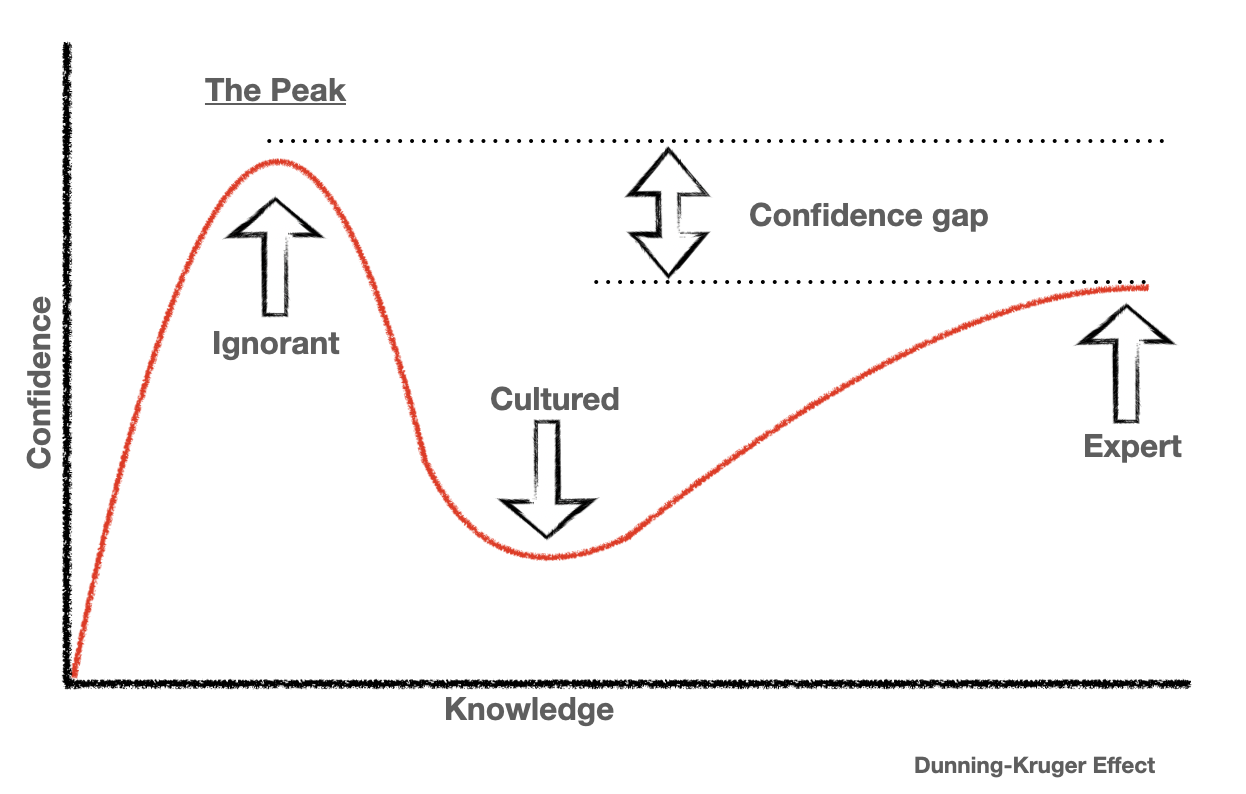

Financial Knowledge Asymmetry

Despite increased access to SME financing, many small businesses and entrepreneurs lack the resources to employ a dedicated finance role, and therefore struggle to understand the available options. According to the UK Treasury, 72% of SMEs in the UK don’t have a financially qualified person on their team.

In a recent UK survey, SMEs named “accessing external finance” as their poorest area of expertise.

Often the burden of managing finances lies with the management team, the founders or their overburdened bookkeepers, accountants or bank managers.

As a result, most SMEs only realize they need financing 1 week before they actually need it.

It’s no wonder that only 12% do more than 1 hour of research before applying for a loan. SMEs need access to knowledge and information to help support their financial decisions.

tomato pay

At tomato pay (formerly Fractal), we’re codifying the brains of CFOs into one unifying app, and democratising access to financial information for SMEs, helping them better manage their cash and capital requirements.

We seamlessly connect to their business data, notably their accounting and payment data, and address their pain points with three strategic pillars.

A. Automate financial analysis and insights; building their financial knowledge and giving them an efficient management solution, and the confidence to make informed decisions.

B. Build, share and communicate business narratives centred on their metrics with colleagues, advisors, accountants or financiers.

C. Connect them to the right financial services product and provider, at the right time.

Conclusion and Summary

It’s an exciting time to be in the financial services sector. There has never been a better time to be a consumer or SME.

If we can draw any positives from the great recession of 2008, it’s that the destabilisation of the banking system coupled with the continued development of technology has created incredible financial innovation.

These innovations are further democratising the access to knowledge, and pushing the entire industry forward.

References

- Stein, Ventura, Tufano, “The Future of FinTech: A Paradigm Shift in Small Business Finance”. World Economic Forum, October 2015.

- McKinsey & Company, “Cutting Through the FinTech Noise: Markers of Success, Imperatives For Banks”. December 2015.

- E&Y, UKTI, “Landscaping UK Fintech”. March 2016.

- House of Commons Treasury Committee, “Conduct and competition in SME lending”. March 2015.