Today, we believe that account-to-account payments are the next natural step for the fintech world.

The current economic landscape

Although the UK is now out of a recession, the growth curve has been slowing down in September and the amount of public debt exceeded 100% of the GDP for the first time since 1963. The government help schemes have been vital to save the economy and those impacted by lockdowns and restrictions. However, these initiatives have also led to instability and created a volatile job market, with little to no jobs and many dealing with unemployment.

But amidst all this hardship some positive aspects have emerged during this pandemic. Our society has finally recognised how important it is to use technology to make our life easier and more convenient. Covid has created a channel for new, innovative and creative ways of handling technology. Additionally, McKinsey & Company found out that Covid-19 has increased the adoption of digital technology by several years.

Digital innovation in payments and beyond

We cannot forget the prime example for digital innovation: Open Banking. Back in 2018, Open Banking revolutionised the financial market and paved the way for fintechs to transform small business and retail banking fundamentally - and it hasn’t stopped evolving. Experts working at and outside the OBIE agree that the next step following Open Banking is now Open Finance and payments.

Today, the way we make payments is becoming increasingly outdated. Plastic cards are not only bad for the environment, but they can also attract bacteria and could be considered unsanitary, shown through the mere fact of entering pin codes, a method that does not exactly encourage social distancing and contactless transactions.

Furthermore, due to repeated lockdowns and shutdowns of the economy, small-to-medium-sized-enterprises (SMEs) are in dire need of our help. They shouldn't be subjected to heavy card payment fees and having to wait weeks for a cash settlement in their bank.

This is why industry players are speculating that over 40% of online payments will be done through account-to-account mechanisms in the future; that there is a growing customer base in favour of easy, real-time payments.

This is only enhanced by the fact that not only are there more payment options, but the needs and wishes of the customer are rapidly changing. Nowadays, consumers want intelligent payment solutions to help them efficiently handle their cash. Payment’s firms such as WeChat introduced the concept of an all-encompassing payments service and has seen great success in China. Customers now want banks that are more than just a branch - they’re looking for the best deal possible, not only for their money but also for the overall experience.

This all channels into one thought: account-to-account payments are next on the horizon.

But what exactly are they?

Account-to-account payments is an offspring of Open Banking. Open Banking allows third parties to execute payments from the accounts of customers on their behalf. This creates a process that transfers money directly from one account to another. This is possible on the base of the licensed Payment Initiation Service Providers (PSD2). The payments are initiated through APIs that are directly connected to the bank.

What are the benefits?

- It is very secure. PSD2 requires strong customer authentication and has introduced steps to prevent online fraud.

- It is cheaper. 11FS found out that in 2016, £904 billion were spent on cards in the UK. A high street business pays in general 0.7% for debit card transactions and 1.3% for credit cards transactions. Furthermore, payment processors such as iZettle and Stripe charge 1.75% of the amount charged. Skipping the middleman can save small businesses a lot of money.

- More hygienic. We mentioned before that the typical method of card payment is not in line with social distancing and non-touch policies. Account-to-account payments, on the other hand, can be done from a distance and don't involve tapping in or tapping out.

- It's faster. It can take a while until the money reaches the account of the business that has been paid. As account-to-account payments eliminate the parties in between and the money is transferred faster.

- It's ethical and fairer to SMEs and sole traders. The combination of receiving money they are entitled to near enough instantly, and paying cheaper transaction fees whilst being able to provide their customers with contactless payment opportunities, are greatly needed in a pandemic with profound economic repercussions.

Community has never been as important as it is today, and watching the business and sole trader community struggle throughout the past year has spurred us on to take a more community-led approach to our business.

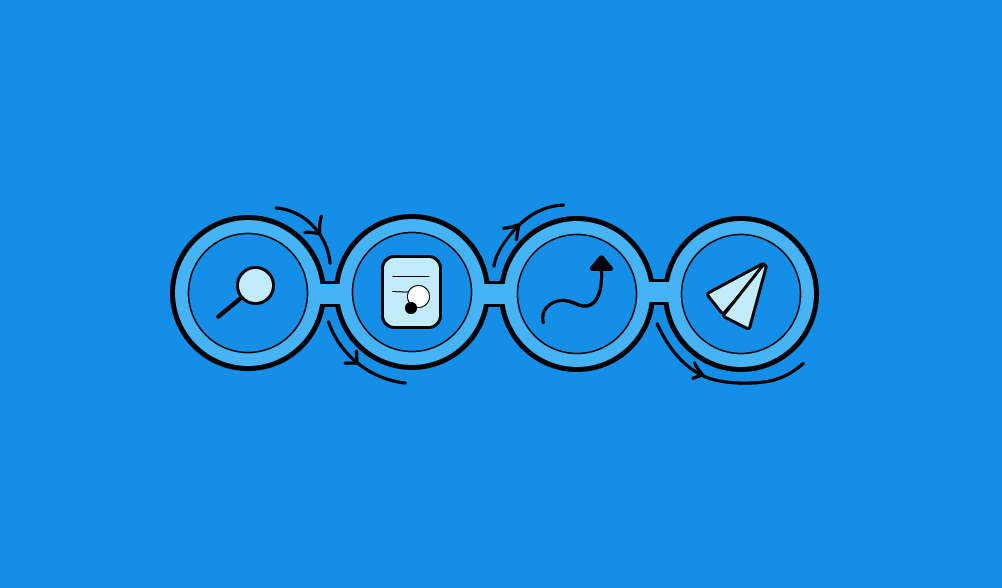

tomato pay is a simple, QR-code based payments and invoice app powered by Open Banking and built on our tomato pay API platform which offers both AIS and PIS capabilities.

Businesses and sole traders can benefit from our low-cost QR-code payments solution with no hidden fees, which saves them money compared to their current payment systems, gives them instant access to their money as cash settlement happens almost immediately, and access to all of their bank accounts in one place.

Businesses and sole traders can benefit from our quick and easy invoice solution. Invoices can be created within the app, with the option to give discounts and late penalties (pre-built into the app using gamification and behavioural science) and send nudges to remind customers and clients to pay. Plus, as you connect your bank account, payments are embedded within the app - so no need to give your bank details, and receive money owed instantly into your account.

Everyone can support their local communities thrive by paying their neighbourhood businesses in a cashless, hassle-free way.