We always enjoy speaking to other small businesses, so we jumped at the chance to speak to Josh Winterson, CEO and founder of Alinea, about everything tomato pay (formerly known as Fractal), and why diversity is so important in small companies.

You can read Josh's interview with our Chief Product Officer, Gaurav Katyal here, and below.

If you want to learn more about tomato pay, then we would love to chat to you. You can book some time to talk to one of our team members by emailing us at info@tomatopay.co.uk, or you can sign up through our contact form.

In the meantime, don't forget to sign up for our developer portal!

Hi Gaurav, could you please start us off with an introduction?

Sure, I’m Gaurav Katyal and I’m formerly known as Fractal, tomato pay Chief Product Officer.

I’ve been directing product vision and leading product teams for over a decade now.

Over the last five years I made the switch from working at big corporations to start-ups. Personally, I’m very passionate about taking the product in an early-stage company from the idea stage to a product-market fit.

I get really excited by using concepts from consumer psychology, motivation theories, design thinking, gamification, data science and behavioural science to solve real-world problems - all topics I am covering in my book that will be published in the near future.

What inspired you to join tomato pay over the thousands of tech start-ups in London?

I met Nicholas Heller, CEO and co-founder of tomato pay about two years ago. He was truly inspiring - he went through his vision and how he created tomato pay, formerly known as Fractal, to empower small businesses.

I was really motivated to learn more about the importance of tomato pay mission - small businesses are the backbone of any thriving economy, yet are underserved by their financial providers. If you speak to any small business owner, they are very passionate about what they’re doing, yet they really suffer when it comes to managing their finances.

82% of small-medium-sized-enterprises (SMEs) actually fail because they cannot manage their cash flow effectively, and that is a huge problem - it’s not just a financial problem for the businesses, but actually a larger problem for the UK and global economy. This spurred me on as I saw two challenges - how can we build a product that can help these small businesses with little-to-no disruption to their day-to-day work, and how can we help them get better services from their financial providers to help them succeed.

If we all help small businesses succeed, then we will help the overall state of the economy which will create better jobs, improve the GDP of the country, and improve the quality of life for business owners as well. Also, I believe that we’ll see more entrepreneurship and innovative services and products on the market as a by-product of us supporting small businesses.

Sounds like a great mission. Could you tell us about tomato pays product suite?

Sure. Our platform started off humbly where we presented a cash flow forecast back to the business owner with insights on how they can better manage their finances.

Then, in 2018, we were at the forefront of Open Banking as soon as it came into play. We successfully integrated with a number of the CMA9 banks to get real-time data, which allowed us to provide better financial insights.

Now, as we’ve grown and taken into consideration market changes, we have developed a sophisticated API platform where developers or financial institutions can sign up and start building applications for their customers.

Our suite of APIs consists of a banking API, an accounting API, a forecasting API, a categorisation API and a payments API.

To break it all down for you, our banking API allows the end-user to connect to multiple banks, fetch data on multiple accounts like transactions and balances, and help small businesses build a complete picture of their finances. This helps small businesses who are multi-banked. For example, a small business owner would check their HSBC account for their outgoings, and then their Barclays account to check their international payments, and so forth.

We then have our accounting API which collects data from their current accounting software where we match the transactions between both a small business’ accounting software and their bank accounts.

Then we have our categorisation API, which makes our offering unique. Most competitors categorise transactions on a retail level, so they categorise into food, entertainment and so forth. However, when it comes down to business transactions it’s very different. We categorise revenue, marketing costs, IT costs, rent etc. This means that a small business owner can get a snapshot of their finances in a second.

We also have our forecasting API where we have set a high standard of forecasting for small businesses. We look at trends in their banking data so we can predict what their cash flow is going to be over time. We look at their accounting systems and begin to see invoices and bills coming up and calibrate our forecast based on invoicing and bills. We also help SMEs add their own transactions to it as well, as there are costs that we will never be able to predict immediately - for example, if they are going to buy a new building, or hire a new member of staff - these are transactions we cannot get from historical data.

Using all of this, we can build a really sophisticated cash flow forecasting tool for SMEs.

Lastly, the fifth key product in our offering is our Payments API, which we are really excited about because we think there’s a huge opportunity to be had there. Today, the biggest pain point that we see for SMEs is that there are so many different types of payments to be made like paying rent, salaries, invoice payments, and that’s such a manual process right now. For example, we speak to SME owners and they have to pay salaries monthly by logging into their bank account and pay each person one by one. It’s actually shocking that this still happens in 2019. This process should all be automated, and that’s where our Payments API comes in. Furthermore, SME owners who work really hard to launch their products but they end up paying a huge amount in transaction fees to people like VISA and Mastercard. The way we see it, with the new Open Banking specifications, they can just simply transfer from one account to another. For example, if I transfer money to your account, Jake, I don’t pay any fees and it’s made possible with Open Banking, and we’re going to expose that using our Payments API.

You’ve been here for two years now, how has that been, and can you highlight some key achievements?

A lot has been achieved over the past two years.

I’m particularly proud of how we’ve made an enterprise-grade, scalable platform with such a small team. Then there are a lot of other achievements, we’ve won many fintech awards, competitions like Nesta’s Open Up Challenge, OP Financial Open Banking Challenge, Shift Money, EBA day, the list goes on.

We’ve also had many opportunities to partner with Tier 1 banks, and as a small team that is an incredible feat.

That’s great considering that you’re a start-up and you’re given the trust to work with Tier 1 banks.

I’m also proud of the diversity of the team as well. The team is around 25 people at the moment and we have so many different nationalities, ages, people with different types of professional backgrounds. We know that we need a diverse group of people to get the breadth of experience needed to make an inclusive, working product.

How have you done that? Diversity seems to be focused a lot around gender diversity but not on the other, many different types of diversity as well.

It goes back to what you asked me earlier about why I joined tomato pay, formerly Fractal. I was inspired by tomato pays mission - to empower SMEs.

The second reason, and equally as important as the first, was the team; the people are a very inspiring and diverse group.

Nick, our CEO, is great. He’s Canadian, he worked for Google for many years and brings a lot of energy on the sales, marketing and advertising side for tomato pay. On the technical side we have Jerry, our CTO, who has worked in big financial institutions like JP Morgan, and fintech companies like iwoca & Growth Street, and he really knows how to build technical, scalable teams. We then have Peter, our COO, who is Swedish and who has worked for large banks like Deutsche Bank who brings in a wealth of financial expertise. Both our board and founding team are 50/50 male and female, and all derive from different backgrounds.

What we wanted to do was to build a company which is culturally diverse, but also diverse skill-wise. In a start-up it’s unheard of having a behavioural scientist, but we have one in our team who looks at how to speak to small businesses.

At this stage of the company, we are very much a family. We celebrate events, birthdays and achievements. If something goes wrong, we all get together and brainstorm on how to solve the problem.

Anything else that you would add?

One thing we’ve really focused on is having fun while solving big problems! People always talk about how hard it is working in a start-up, and enjoying life can easily fall by the wayside.

That’s not something that you always see in a start-up! If we look to the future, what does 2020 look like?

2020 is exciting. We have a few product launches lined up, one will be the launch of a mature payments product in the market.

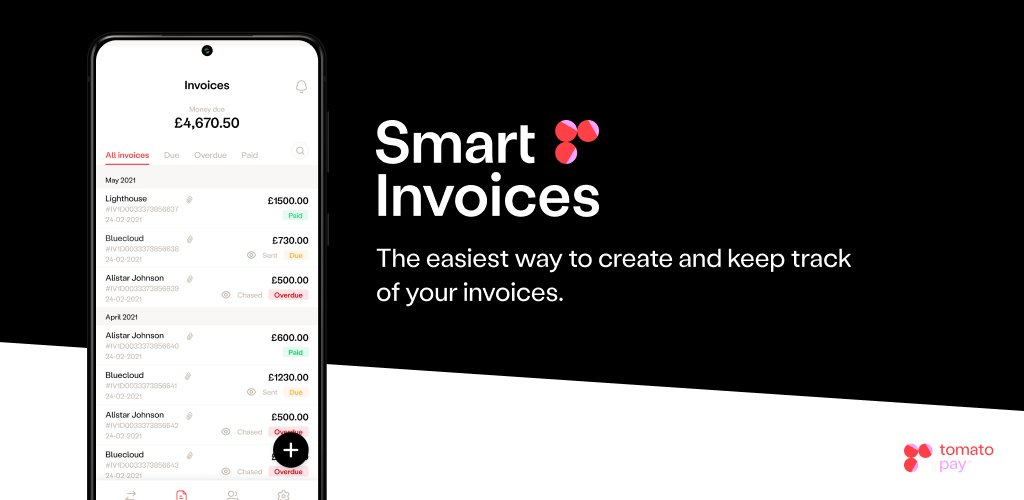

More specifically, we are launching a product called ‘Smart Invoices’ that we believe will solve a huge challenge faced by small businesses in the UK.

One of the main problems is that most invoices are paid late, and because these payments are made late it disrupts the workflow and cash flow of SMEs meaning that eventually, the SME may fail due to cash flow issues.

We’re really excited about how Smart Invoices are going to solve that problem. We’re using gamification and behavioural science to motivate an SME’s customer to pay on time by offering discounts or penalising them if they pay late.

This year, we’re going to build out our commercial organisation so that we are able to talk to more financial institutions, expand into new markets (we have offices in Australia and Finland) and all of this will help us to claim a bigger share of the market.

Why Australia?

Mainly because of Open Banking. They are releasing their first-ever Open Banking platform in early 2020. We see that as a huge opportunity as the banking culture is so similar to the UK; they operate very similarly to the UK, and their banking stack is also very much the same.

Sounds like it’s a solution that serves the underserved! Could you tell us a bit about your current customers in the UK?

Currently, we are only working with the Tier 1 banks. A good example of that is Santander, who is one of our clients.

We have an amazing partnership with Deloitte, who are a partner, client and investor. They are using our API platform to build a product that solves many of the challenges SMEs face with cash flow.

We were also the first company on their new fintech portfolio as well as they saw the potential. It really validates what we’re doing as well.

Why did they (Deloitte) say that they picked you? I can imagine it was quite competitive.

They had a close relationship with us for a few years, saw how we were growing and recognised that we had a great product-market fit.

We work from their innovation lab on the 4th floor here at WeWork, so they’ve been able to see our progression quite closely. You should see how excited the Tier 1 banks get when they come and see us, because we are fortunate enough to have access to their beautiful showcase room and Deloitte gets a front row seat to watch how financial institutions feel when they visit us.

I can imagine it’s amazing from a networking perspective as well, with a huge name like Deloitte backing you so openly.

Definitely. And from a product perspective, they can see how just by unifying their accounting and banking data through our APIs, they genuinely can solve so many problems that SMEs face. For an auditor like Deloitte, that’s super beneficial!

tomato pay, formerly known as Fractal was recently included on Tech Nations latest fintech cohort, how do you think it will help?

Tech Nation is one of the most prestigious scaleup accelerators out there. We’re a small team so we need to be really careful where and how we use our time, and we’ve seen how other cohort members have scaled since joining Tech Nation over the years.

We are currently seeking our next round of funding and investors are impressed when they hear that formerly known as Fractal, tomato pay are a part of Tech Nation, who have a proven track record of working with successful fintechs. We’re at 25 people now and knowing that we can get the right investment, we want to triple that number in 2020. The benefit of being a part of the Tech Nation cohort is that they can help us figure out the most efficient way of scaling up.

Have you seen a difference in attitude from the banks in terms of wanting to change, especially in the last few years?

Yes, definitely. Now, a lot of big banks are focusing on the SME sector. For example, HSBC launched a product called Kinetic focused solely on SMEs, and Natwest/RBS launched Mettle which is also SME-specific.

The way that they view partnerships is also very different. Banks used to think that they could build everything in-house, but slowly, they are realising that they are great at managing money, but not great at being a tech company. They see the potential of tech companies like Fractal who can help them get to market quicker, and solve problems efficiently.

Despite initial hesitation at first, we can see that banks are now embracing Open Banking which we were one of, if not the first, company to be regulated under PSD2 when it launched.

PSD2 happened recently as well which has pushed the regulation as well, hopefully pushing towards wider adoption.

Absolutely, but it’s still early days. In the UK we have Open Banking/ PSD2 so we can either pull data from banks or we can initiate payments. Every bank is different, so there’s a long way to go until everything is standardised.

We really take pride in processing the data, cleaning up that data, standardising it, and normalising it before we pass it on. We know that data is important for SMEs and they make critical decisions from that data, so we really feel that it’s our responsibility to clean up that data rather than just pass it on.

On a personal note, you’ve been working in start-ups for the last 5 years. What advice can you give to somebody who wants to join a start-up?

If you’re looking to join an early stage start-up, then you need to be really passionate about the company’s mission. Due to the nature of start-ups, things can get a little stressful, and in those moments of stress, that’s when you really need that passion and the belief in the cause to carry on.

Secondly, I’d say focus. There are so many problems to solve but as a small, early stage start-up, you have to pick your battles. Really focus on the right problem and don’t waste your energy on the wrong problems.

Thirdly, be open minded and open to experimentation. A lot of people get very emotionally attached with their ideas, and in a start-up you need to be open to new ideas and embrace changes as you move along.

Finally, what’s the ultimate goal for Fractal Labs and if you were to look back on the company in 10 years, what would it look like in a perfect world?

The ultimate goal is to make a small business owner’s life as easy as possible on the financial management side.

If you look at the figures from the World Bank, or the UK government, there’s a $5.2 trillion funding gap for SMEs, and there’s a £38 billion funding gap in the UK. This is a huge problem.

10 years from now, if we have done our job right, we would have nearly eliminated the funding gap issue I mentioned above. How we see it is, SMEs shouldn’t have to rely on funding unless it’s for growth - they shouldn’t fail because of cash flow problems. We can help make banks become more efficient by helping their relationship managers target the right products, to the right SMEs, at the right time.

There’s another huge gap in the market today - we know that banks make their money either via lending products or by securitising the loans into capital markets. That securitisation works well for corporate and retail sectors, but for SMEs there’s a huge gap, and that’s because the data for SMEs are very fragmented. If we do our job well, we’ll be able to structure the data for any SME and create new revenue streams for the banks.

Currently, banks don’t serve their SME customers well because they don’t see them as profitable. If we can structure that data and help create another revenue stream for banks by helping them target the right products at the right time, and by helping them securitise loans in capital markets, it will change the perception of SME lending. Hopefully they will invest in serving SMEs properly once they make this fundamental change in their thinking and realise the opportunity here to serve the community that is currently the backbone of the UK economy.

.png)