The UK Government has put a charter in place to aid SMEs in getting paid by big businesses and government agencies. However, there is a lack of support for SME to SME or business to consumer debt. The Government stimulus has given a distorted view of business performance since the start of the pandemic.

Pre-pandemic UK SMEs were facing a £50bn late payment problem. 18 months later and this has grown significantly. Combine an increasing £100bn of unsustainable national debt (due to government support) with a lack of access to future funding options for businesses and it’s been predicted the insolvency rates of UK SMEs will rise significantly towards the end of 2021.

Adding other factors; Brexit, furlough now ended, the abolition of the VAT reverse charge within the construction industry, and zombie companies, many business directors find themselves needing to repay the loans having used personal assets as guarantees against funding. There is undoubtedly a severe and unsustainable disruption to the UK economy at play.

These interconnected risks will make it difficult to optimise working capital and collect outstanding debt. It’s important that every business rethinks how they manage their cashflow position. Many tools highlight issues, give insights or provide a temporary solution, without solving the underlying systemic problem. Our goal is to solve this issue at the root.

The pandemic has created a perfect storm and made it difficult for many companies to recover to their pre-pandemic levels. Even with the funding boost, they have received. We are seeing many of these businesses now over-leveraged, looking for additional funding or financial support. Still, access to working capital is one of their biggest challenges. And the late payment challenge is only getting worse.

There are currently 3.1 million companies trading on credit in the UK.

More than 1.4 million of these firms have had their cashflow negatively impacted by customers who don’t pay their invoices on time.

Partnership

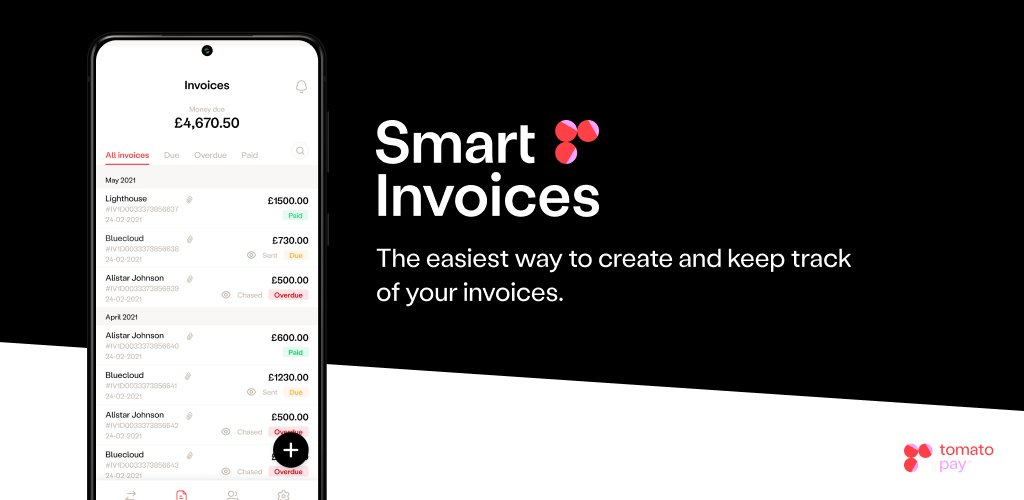

Itsettled and tomato pay are uniquely positioned to address the late payment problem by combining tomato pay smart invoices with itsettled’s tried and tested cashflow & credit management platform.

Together, both companies will offer their SME customers a combination of tools that can fundamentally change the credit risk profile of these businesses and help them get paid on time. By starting upstream with tomato pay smart invoices, SMEs will have full control over the quote - contract - invoice process and give their debtors an easy and safe way to pay these invoices via link or embedded QR code. If an SME is still waiting for payment on these invoices, they can seamlessly kick off the itsettled automated collections process in a few clicks. In the last 12 years, the itsettled system has helped over 1500 businesses and their accountants collect debt totalling £420 million. In total, the proprietary itsettled process has collected in excess of £3.5bn.

As an added benefit for SMEs already using the itsettled platform, they will soon be able to create and add tomato pay payment links directly to their existing invoices or in automated letters sent via itsettled. By presenting a debtor with tomato pay’s QR code to instant bank transfer flow, SMEs can be assured that the money they are owed will arrive in the correct bank account and in gross-real time.

Commenting on how both companies can make a material difference in the business health of their SME customers, tomato pay’s Head of Strategic Partnerships Louis Demetroulakos said,

“itsettled’s process and results speak for themselves. The combination of the itsettled system with tomato pay’s leading Smart Invoice and payments solutions is a no-brainer for SMEs looking to get paid on time and avoid any unnecessary fees or manual payment errors. We are thrilled for the opportunity to work closely with itsettled on this critical mission.”

Itsettled Chief Commercial Officer David Beer echoed the sentiment saying,

“We are excited to work with tomato pay on this landmark partnership. SMEs want solutions that are smart, automated and easy to use. Together we solve a critical SME pain point with our combined interconnected solutions. The UK's working capital challenge. We allow SMEs to get paid on time, improve their cashflow and become lending ready.”

About tomato pay:

tomato pay is a QR-code based payments and invoice app used by businesses and sole traders who want to receive payments in a safe, streamlined, and cost effective way. Businesses and sole traders can benefit from a low-cost QR-code payments solution with no hidden fees, which can save money and time compared to current payment systems. It offers instant access to money as cash settlement happens almost immediately. It also offers access to all bank accounts and transactions in one place. Invoices can be created within the app, with the option to give automated discounts, late penalties and send nudges to remind customers and clients to pay. Plus, businesses can connect their bank account as digital payments are embedded within the invoice from the app - so no need to send bank details, and businesses will receive money owed instantly into their account. Everyone can support their local communities and help them thrive by paying their neighbourhood businesses in a cashless, faster, cheaper, hassle-free way.

About itsettled:

itsettled has been built on CEO Glen Morgan’s 25 years of credit management experience. We’ve codified a proven process previously only available to large corporates and made it available to all UK SMEs.

itsettled is an automated cashflow & credit management tool for business owners who need support to manage this process or don’t have the experience, time, money, or resources to manage credit control themselves. We give them the peace of mind that we optimise their cashflow position and protect them from future risks.

After integrating itsettled with their accountancy software or invoicing tool, our platform gets to work. It proactively identifies potential payment issues and automatically manages the business’s invoice portfolio. We provide the knowledge and support they need to maintain a strong working capital position, while maintaining strong customer relationships. And if disaster strikes, and they don’t get paid, we will recover the money at no additional cost.

.png)