We are proud to announce tomato pay's partnership with APImetrics, a leading provider of monitoring for hard-to-monitor production APIs in regulated sectors like finance, with clients at major banks, telcos, and IT companies, to launch the first independent production monitoring dashboard for Open Banking APIs.

Nicholas Heller, CEO and co-founder of tomato pay stated: "For business and brand protection, we needed to know not only what was working, but what potentially was outside our control that might negatively impact us. APImetrics gives us that assurance. The logical move was for us to partner to provide that level of assurance to the entire ecosystem and provide some much-needed accountability. tomato pay is thrilled to partner with APImetrics to bring unparalleled insight into Open Banking production APIs in the UK. The API.expert dashboard allows for greater transparency into the APIs that make Open Banking function and gives service providers an immediate pulse on service uptime and connection quality. By leveraging tomato pay’s robust Open Banking connections in the UK, API.expert will provide financial institutions and technical service providers with the critical data they need to better serve customers.”

David O’Neill, CEO of APImetrics stated: "Open banking is here to stay, and we both want it to be a huge success. Being able to see independent, third-party quality data is an essential first step for trust in the ecosystem. Especially one where almost a quarter of the providers are providing sub-standard services. Any ecosystem is only as strong as its weakest providers, but customers only see the app in front of them, not the different API services behind the app, each of which is potentially a weak link. That’s critical for tomato pay, but also critical for their customers and any other providers and consumers in the new open banking and payments ecosystem."

You can see our partnership featured in Finextra, Paypers, EIN News, IBS Intelligence.

Community has never been as important as it is today, and watching the business and sole trader community struggle throughout the pandemic has spurred us on to take a more community-led approach to our business.

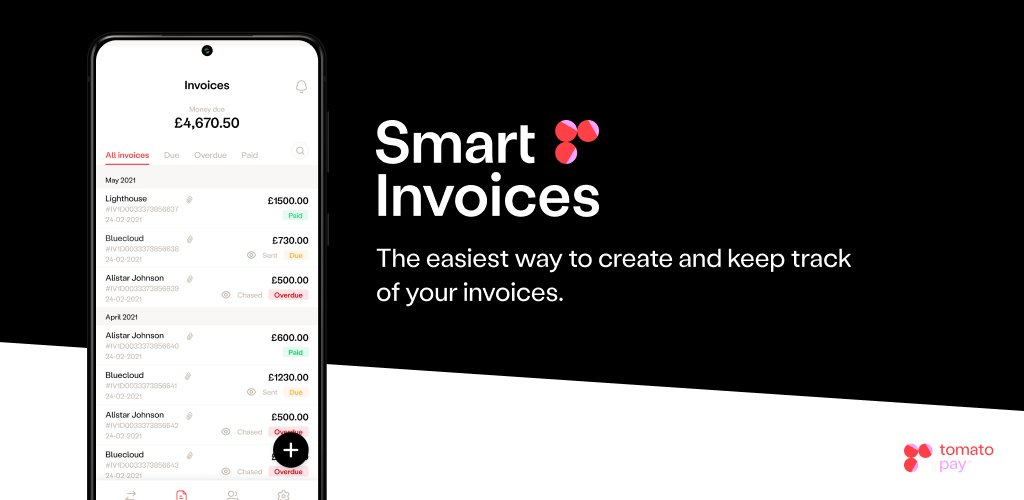

tomato pay is a simple, QR-code based payments and invoice app powered by Open Banking and built on our tomato pay API platform which offers both AIS and PIS capabilities.

Businesses and sole traders can benefit from our cost-effective QR-code payments solution with no hidden fees, which can save them money compared to their current payment systems, gives them instant access to their money as cash settlement happens almost immediately, and access to all of their bank accounts in one place.

Businesses and sole traders can benefit from our quick and easy invoice solution. Invoices can be created within the app, with the option to give discounts and late penalties (pre-built into the app using gamification and behavioural science) and send nudges to remind customers and clients to pay. Plus, as you connect your bank account, payments are embedded within the app - so no need to give your bank details, and receive money owed instantly into your account.

Everyone can support their local communities thrive by paying their neighbourhood businesses in a cashless, hassle-free way.

tomato pay is an FCA-regulated authorised Account Information & Payment Initiation Service Providers (AISP/PISP) provider. You can find us on the Open Banking Directory, and on the FCA registered list.

.png)