In mid-March, at the start of lockdown, it was said that one of the biggest changes to the economy would be the huge numbers of inevitable business closures due to the fall in trading. In turn, this had a catastrophic effect on the UK and global economies. Sadly, by mid-April, it was reported that one-quarter of UK companies have temporarily closed, and the majority of those still operating have reported lower turnover. Furthermore, 21,000 UK businesses collapsed in March.

Today, small businesses continue to take a financial battering and face further distress as previous financial challenges have multiplied in size because of the ongoing pandemic. Businesses have had to defer payments, take out emergency financing from government initiatives (CBILS, BBLS, SEISS or the Future Fund) or use money earmarked for other expenses.

Although the outlook is grey for businesses right now, we should remember that pre-lockdown navigating the financial landscape was no walk in the park either as financial institutions proved incapable of servicing the small business sector properly, and the late payment problem continued to grow.

According to the FSB Time to Act report, small businesses are owed on average £6,142, and as a consequence of not being paid on time, 37% experience cash flow difficulties and 30% have been forced to use an overdraft. Retail payments authority Pay.UK shows that the balance of outstanding late payments almost doubled to £23.4bn in 2019. Furthermore, the average wait time for unpaid invoices grew from 12 days in 2018, to 23 days in 2019.

The findings follow previous research from Pay.UK, and FSB that shows the UK late payment crisis could lead to the closure of 50,000 small businesses a year at a cost of £2.5bn to the economy.

It can only be assumed without proper reporting, that these figures have only been exacerbated over the last few months.

At tomato pay (formerly Fractal), we’ve spoken at great length about the importance of helping small businesses with cash. We have worked with financial institutions over the past two years to provide the technology that allows them to deploy tailored funds to small businesses at a lower rate, quickly. Although financial institutions are relied on heavily for funding, there is another financial entity that is heavily relied on by small businesses to help them understand their cash - accountants.

That’s why we’re excited to partner with untied - a disruptive business who provide the likes of Deliveroo and Deloitte, Propel a simplified tax returns service.

Together, tomato pay and untied are joining forces to design SMART (SMEs Manage Accounts Receivables and Tax), an initiative to address and solve the administrative burden of chasing receivables for a sub-sector of small businesses - sole traders.

75% of SMEs in the UK, or 4.4m of the 5.9m in total, have no employees. These can range from street market vendors and restaurants to hairdressers, electricians and plumbers. They are key drivers to the UK economy.

With lockdown halting normal trading, sole traders are working hard to overcome the many hurdles thrown at them including how to support themselves without the income deriving from sales of their services and products. Many have had to turn to external funding that they otherwise would not have considered, and have to work with finance providers who are not equipped to help each business’ unique profile.

It was reported that 14% of British small businesses use credit cards and one in five small businesses go into their bank overdrafts to plug holes in their cash flow, a proposition that according to the FSB, is deemed unaffordable and which is not sustainable, especially now.

Sole traders desperately need the right support to overcome certain challenges, in particular, revenue management, the highly discussed pain point - understanding cash flow, and payable and tax payments.

Revenue management

Traditional banking tools fail to help SMEs with their business operations, including invoicing and converting their receivables into cash. Underfunded working capital, long payment cycles and high costs to receive payments (either via cards or by manually chasing and reconciling payments) create substantial costs. This is a material issue: one report showed that out of 500 business owners, almost half of invoices were paid past their due date, and 76% of them agreed that having their own business would feel more “worth it” if cash flow was not such a problem.

Understanding cash flow

Sole traders often work alone, as taking on new employees means paying them directly from their cash earned. That normally means that unless the business owner is a financial expert, there is no one to manage the financial side of the business.

Very few sole traders use technology to forecast their cash flow or take the necessary measures to ensure sufficient cash management because tools are available, and the ones that exist, are usually configured for larger businesses or as clunky, standalone products, which are not easily integrated into the day-to-day operations of the business. Of businesses with cash flow issues, only 18% set aside money to cover their taxes.

Understanding payables and tax payments

It is critical for a sole trader to fully understand its payables, notably complexities surrounding tax payments. KPMG research indicates taxes are the third biggest item in a business’s cash flow (after sales and cost of sales). Sole traders bear the burden of interpreting and meeting HMRC’s tax requirements, FSB states that 77% of businesses use a specialist, and 69% hire an external firm.

By addressing these three pain points, both tomato pay and untied hope to support the efforts towards rebuilding the UK economy through sole traders, who before coronavirus hit the world, contributed greatly to UK GDP.

More information on the tomato pay and untied SMART initiative

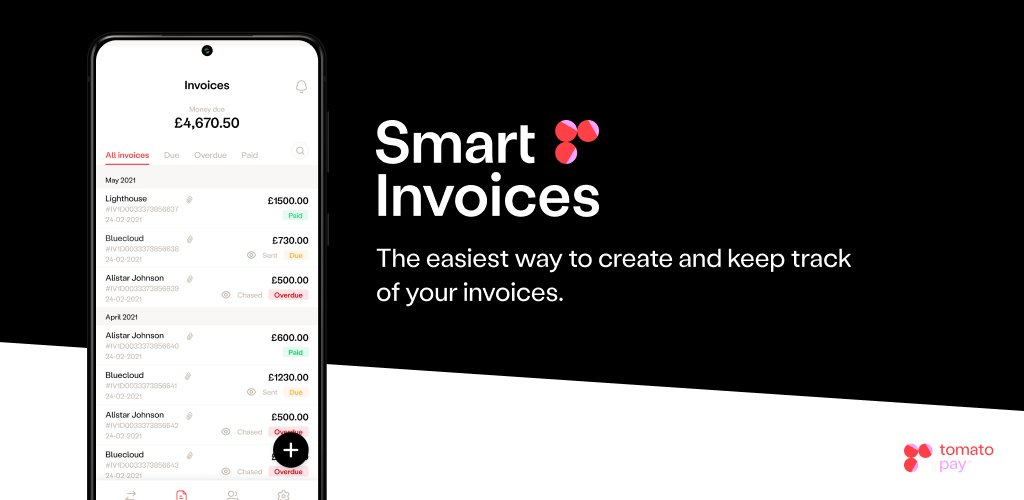

SMART empowers sole trader's to easily invoice customers, and track and incentivise payment through discounts and penalties using best in class behavioural science techniques. tomato pay's payment initiation service facilitates revenue collection through open banking transfers by embedding payments in the invoice, minimising the friction in the payment process and putting dynamic control of payment instructions in the hands of the business.

tomato pay and untied estimate that by 2025, the commercialisation of the SMART app will help decrease average outstanding debt to SMEs by 29% saving the UK economy £1 billion per year.

The project focuses on building out dynamic discounting, automatic late penalty fees and open banking-powered invoice payments functionalities into existing tools. The full-featured project allows for the build-out of integrated credit risk rating of counter-parties, which serves as an important indicator when setting invoice terms, discounts and late penalty fees, ultimately increasing SMEs control over revenue collection.

Community has never been as important as it is today, and watching the business and sole trader community struggle throughout the past year has spurred us on to take a more community-led approach to our business.

tomato pay is a simple, QR-code based payments and invoice app powered by Open Banking and built on our tomato pay API platform which offers both AIS and PIS capabilities.

Businesses and sole traders can benefit from our low-cost QR-code payments solution with no hidden fees, which saves them money compared to their current payment systems, gives them instant access to their money as cash settlement happens almost immediately, and access to all of their bank accounts in one place.

Businesses and sole traders can benefit from our quick and easy invoice solution. Invoices can be created within the app, with the option to give discounts and late penalties (pre-built into the app using gamification and behavioural science) and send nudges to remind customers and clients to pay. Plus, as you connect your bank account, payments are embedded within the app - so no need to give your bank details, and receive money owed instantly into your account.

Everyone can support their local communities thrive by paying their neighbourhood businesses in a cashless, hassle-free way. Join the waitlist.

.png)