tomato pays (formerly known as Fractal) view on the UK Government’s 2020 Budget, delivered by UK Chancellor, Rishi Sunak, on Wednesday 11th March

As global markets continue to stumble throughout the current Covid-19 epidemic, this year’s hotly-anticipated budget began on the topic of the virus outbreak. The new Chancellor, Rishi Sunak, said that he, “promises to keep the country healthy, and financially secure throughout the Covid-19 outbreak. This year’s budget provides for security today, but it is also a plan for tomorrow”.

Occurring twice a year, the Spring and Autumn budget outlines the government’s promised investment to relieve any of the UK’s immediate challenges, and future plans.

We are always eager to see how the budget will affect small businesses, who Sunak mentioned are, “the lifeblood of the UK economy.” Small businesses are already underserved and severely underfunded. Several actions have been promised as outlined below, and we are keen to see how this impacts small businesses over the coming months.

Furthermore, we were pleased to see the fintech industry highlighted in this year’s Spring budget, more so this time than in recent years. The fintech industry works hard to help these underserved communities, and improve the current state of the financial services we all receive today. The fintech industry is critical to an open, transparent financial ecosystem, providing more opportunities for the masses.

tomato pays view on the 2020 Spring Budget:

“For decades, small business owners have demanded that they get better financial services. Finally, the budget acknowledges the potential for the fintech industry to supercharge the transformation of financial services to better serve small businesses and consumers. The UK fintech industry generates £6.6 billion to the economy and employs over 76,5000 people of all ages, and from all backgrounds.

Furthermore, it is exciting to see the government’s commitment to convene a summit looking at what further data needs to be made accessible to make it faster and easier for SMEs to shop around for credit. SMEs have to deal with late payments which cause cash flow issues. There is a UK funding gap of £22 billion for SMEs, despite their enormous contribution to the UK economy. There is no better time than now for the UK government to stop ignoring the funding issues SMEs face, and delve into the underlying reasons that have resulted in a lack of tailored credit available in the UK for small business owners.”

How the Spring budget impacts small businesses:

- Sunak announces £2bn of sick-pay rebates for up to 2 million small businesses with fewer than 250 employees.

- The Chancellor announces £1bn of lending via a government-backed loan scheme, with the government backing 80% of losses on bank lending.

- The Chancellor will also abolish business rates altogether for this year for retailers, in a tax cut worth more than £1bn.

- Any company eligible for small business rates relief will be allowed a £3,000 cash grant – a £2bn injection for 700,000 small businesses.

- The Chancellor will reduce the lifetime limit for relief from £10m to £1m. About 80% of small businesses are not affected. The reforms save £6bn over the next five years.

- There will be an increase in the NICs Employment Allowance to £4,000, benefiting 510,000 businesses.

- The Budget also announces the launch of a fundamental review of business rates, due to be reported in the Autumn Budget.

- There will be new financial support for British exporters by investing in additional business support for SMEs through Growth Hubs.

- The government will extend the Start-Up Loans Programme to ensure that would-be-entrepreneurs can access the finance they need.

How the budget impacts the fintech industry:

- There will be an independent strategic review of UK fintech, chaired by Ron Kalifa, OBE. Kalifa will not only look at London but at Leeds, Manchester, Cardiff, and Edinburgh.

- The government will also extend funding for the Fintech Delivery Panel, as well as touring the regions and nations of the UK to showcase its diverse range of fintech firms.

About tomato pay

Community has never been as important as it is today, and watching the business and sole trader community struggle throughout the past year has spurred us on to take a more community-led approach to our business.

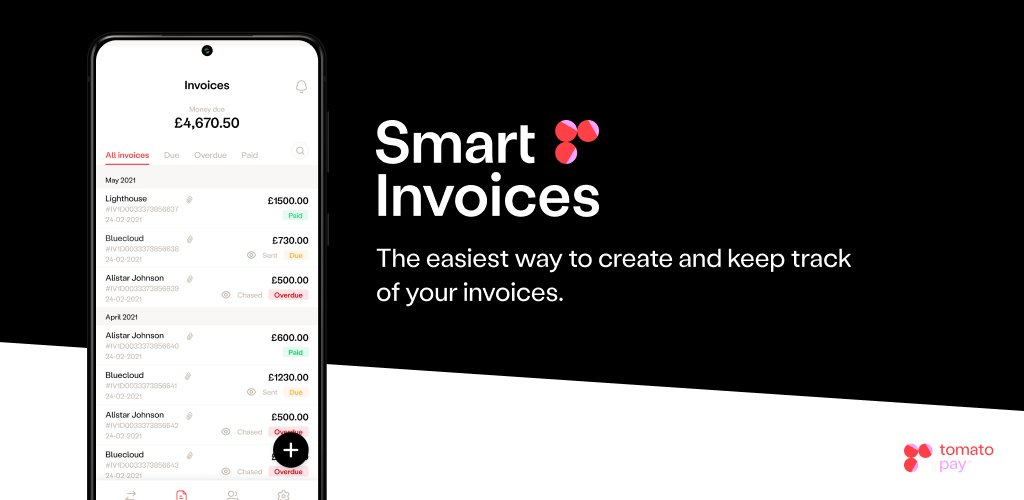

tomato pay is a simple, QR-code based payments and invoice app powered by Open Banking and built on our tomato pay API platform which offers both AIS and PIS capabilities.

Businesses and sole traders can benefit from our low-cost QR-code payments solution with no hidden fees, which saves them money compared to their current payment systems, gives them instant access to their money as cash settlement happens almost immediately, and access to all of their bank accounts in one place.

Businesses and sole traders can benefit from our quick and easy invoice solution. Invoices can be created within the app, with the option to give discounts and late penalties (pre-built into the app using gamification and behavioural science) and send nudges to remind customers and clients to pay. Plus, as you connect your bank account, payments are embedded within the app - so no need to give your bank details, and receive money owed instantly into your account.

Everyone can support their local communities thrive by paying their neighbourhood businesses in a cashless, hassle-free way.

If you would like to know more about tomato pay, and how we are supporting small businesses, feel free to contact us.

.png)