tomato pay (formerly Fractal) and untied to save 50,000 businesses a year with SMART BCR bid.

- tomato pay, a smarter payments engine and insights platform, and untied, a personal tax app, are partnering to create SMART - SMEs Manage Accounts Receivables and Tax.

- The initiative is focused on sole traders, who represent the greatest number of businesses in the UK of which 4.5m of the 5.9m small businesses in total, have no employees. They are key drivers to the UK economy.

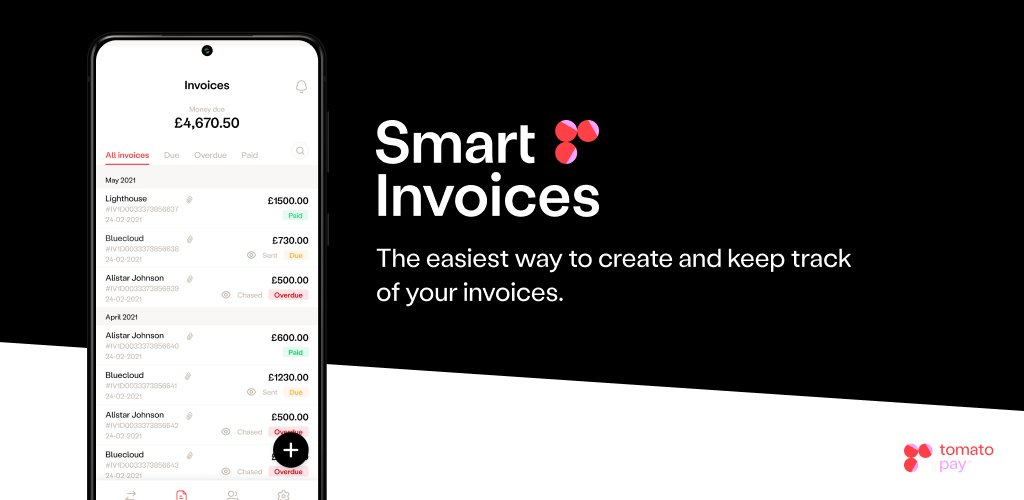

- The tool will help sole traders easily invoice customers, and track and incentivise payment through discounts and penalties.

- FSB states that small businesses are owed on average £6,142, and as a consequence of not being paid on time, 37% experience cash flow difficulties and 30% have been forced to use an overdraft.

- SMART integrates cash flow management by anticipating costs, specifically tax payments. untied reports that 51% of their own users from a sample set of platform workers do not know their own HMRC login which would normally prevent them from submitting their own tax return.*

- tomato pay and untied estimate that by 2025, SMART will decrease average outstanding debt to SMEs by 29%, saving the UK economy £1 billion per year.

[w/c 6th July 2020) tomato pay (formerly Fractal), together with untied, has bid for the Banking Competition Remedies (BCR) Capability and Innovation fund, designed to improve the financial products and services available to small businesses.

tomato pay, a smarter payments engine and insights platform for small-to-medium-sized-enterprises (SMEs) has partnered with untied, the UK’s personal tax app, to create SMART - SMEs Manage Accounts Receivables and Tax.

SMART empowers sole traders to easily invoice customers, and track and incentivise payment through discounts and penalties using best in class behavioural science techniques. The tomato pay Open Banking-powered payment initiation service facilitates revenue collection through faster payment transfer. It does this by embedding payments in the invoice thereby minimising friction in the payment process and giving the business control of its payment instructions.

The initiative is focused on sole traders, who represent the greatest number of businesses in the UK of which 4.5m of the 5.9m small businesses in total, have no employees. These can range from street market vendors and restaurants to hairdressers, electricians and plumbers. They are key drivers to the UK economy, however, they are often overlooked by traditional financial services. tomato pay and untied believes that needs to change.

SMART integrates cash flow management by anticipating costs, specifically tax payments. Unforeseen tax payments are cited as the number one reason small businesses apply for a loan. SMART automates tax calculations in real-time and uses untied’s technology to file directly with HMRC even if someone doesn’t have their own HMRC login. untied reports that 51% of their own users from a sample set of platform workers do not know their own HMRC login which would normally prevent them from submitting their own tax return.* This measurably alleviates the admin burden and associated costs to the worker. untied recognised a change in behaviour from its users - instead of being late for previous filings, people started to complete their new filings for 2019-20 ahead of schedule. This demonstrates that if you give people the right tools, they can do what is perceived as a complicated task, themselves.

According to the FSB Time to Act report, small businesses are owed on average £6,142, and as a consequence of not being paid on time, 37% experience cash flow difficulties and 30% have been forced to use an overdraft. Retail payments authority Pay.UK shows that the balance of outstanding late payments almost doubled to £23.4bn in 2019 and the average wait time for unpaid invoices grew by 11 days to 23 days.

The findings follow previous research from Pay.UK and FSB that shows the UK late payment crisis could lead to the closure of 50,000 small businesses a year at a cost of £2.5bn to the economy.

tomato pay and untied estimate that by 2025, SMART will decrease average outstanding debt to SMEs by 29%, saving the UK economy £1 billion per year.

Nicholas Heller, tomato pay CEO and co-founder said: “Sole traders are working hard to overcome the many hurdles thrown at them caused by the current economic and health crisis. Many have had to turn to external funding that they otherwise would not have considered, and have to work with finance providers who are not well equipped to help micro-businesses. Sole traders desperately need the right support to overcome their everyday challenges, notably revenue management, the highly discussed pain point - understanding cash flow - payables and tax payments.

The BCR Capability and Innovation fund money would accelerate our effort to help these businesses in their greatest time of need. We believe the grant would be best dispersed to fintechs on the ground who can empathise with and immediately support small businesses with the tools they require. Larger businesses will, of course, find the money useful, however, we believe Pool E money would be best used by fintechs who are themselves SMEs.”

Kevin Sefton, untied CEO said: “Taxes are an important part of cash management. They’re particularly complex for sole traders. COVID support has helped many businesses and has highlighted the need for accurate and timely reporting. The SMART initiative is transformational - we don’t just allow taxes to be estimated, but do full calculations and submit filings as well. Its powerful automation saves entrepreneurs time, money and worries, freeing them to get on with stuff that matters to them.

We’ve had a longstanding relationship with tomato pay. We believe strongly in partnership - SMART shows how innovative fintechs can combine world-leading expertise to help the nation’s SMEs.”

*The statistic is based on a sample of 71 real tax returns submitted at untied. Of the 71, 36 people did not know their HMRC login. Covid-19 was noted as a reason for the increased need to file their taxes.

Further information

To find out more about the initiative and our partnership with untied, you can contact Lisa Leid at press@tomatopay.co.uk Or, if you are interested in partnering with us to create new SME-focused solutions, you can contact the team at info@tomatopay.co.uktomatopay.co.uk.

About Banking Competition Remedies (BCR) Capability and Innovation Fund: This is a package of measures with the aim of achieving the objective of promoting competition in the market for banking services to SMEs. It stems from state aid measures given to RBS and approved by the European Commission in 2009. £100m is currently being redeployed through “Pool E”, of which £20m is available to facilitate the commercialisation of financial technology that is relevant to SMEs.

Find out more about the BCR Capability and Innovation Fund

About tomato pay

tomato pay is a simple, QR-code based payments and invoice app powered by Open Banking and built on our tomato pay API platform which offers both AIS and PIS capabilities.

Businesses and sole traders can benefit from our low-cost QR-code payments solution with no hidden fees, which saves them money compared to their current payment systems, gives them instant access to their money as cash settlement happens almost immediately, and access to all of their bank accounts in one place.

Businesses and sole traders can benefit from our quick and easy invoice solution. Invoices can be created within the app, with the option to give discounts and late penalties (pre-built into the app using gamification and behavioural science) and send nudges to remind customers and clients to pay. Plus, as you connect your bank account, payments are embedded within the app - so no need to give your bank details, and receive money owed instantly into your account.

Everyone can support their local communities thrive by paying their neighbourhood businesses in a cashless, hassle-free way. Join the waitlist.

About untied: untied is the UK’s personal tax app. It’s built for people, not accountants and is designed especially to help sole traders to get on top of their taxes. untied is the only end to end app that enables users to link their bank accounts, makes tax sense of their transactions and files directly to HMRC. untied launched untied for gig workers in April, the first tax product designed specifically for these workers. untied’s partners include Revolut, Deliveroo, Stuart and Deloitte. untied is regulated by the FCA, supervised by the Chartered Institute of Taxation and recognised by HMRC.

Find out more about untied.

.png)