We were thrilled to be featured in Metro newspaper last week thanks to a great write-up by Rosie Murray-West.

"How you can use fintech to get more out of your money (the easy way)", shows the possibilities of fintech and Open Banking, especially as it takes it place in the mainstream conscious around financial services.

You can find the full article here.

About tomato pay

Community has never been as important as it is today, and watching the business and sole trader community struggle throughout the past year has spurred us on to take a more community-led approach to our business.

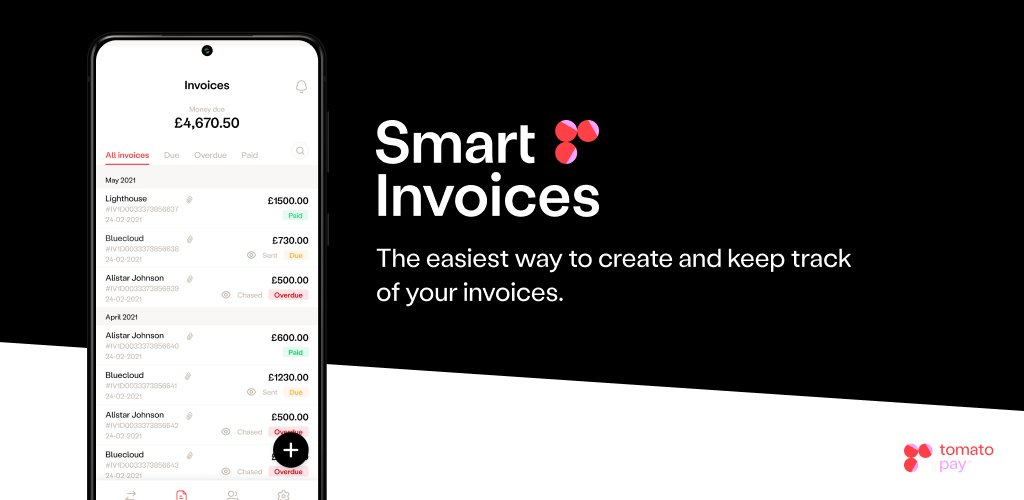

tomato pay is a simple, QR-code based payments and invoice app powered by Open Banking and built on our tomato pay API platform which offers both AIS and PIS capabilities.

Businesses and sole traders can benefit from our low-cost QR-code payments solution with no hidden fees, which saves them money compared to their current payment systems, gives them instant access to their money as cash settlement happens almost immediately, and access to all of their bank accounts in one place.

Businesses and sole traders can benefit from our quick and easy invoice solution. Invoices can be created within the app, with the option to give discounts and late penalties (pre-built into the app using gamification and behavioural science) and send nudges to remind customers and clients to pay. Plus, as you connect your bank account, payments are embedded within the app - so no need to give your bank details, and receive money owed instantly into your account.

Everyone can support their local communities thrive by paying their neighbourhood businesses in a cashless, hassle-free way. Join the waitlist.

tomato pay is an FCA-regulated authorised Account Information & Payment Initiation Service Providers (AIPISP) provider. You can find us on the Open Banking Directory, and on the FCA registered list here.

.png)