Following the success of our participation in the DIT fintech trip to Australia in 2018, and the ensuing traction we got from the market, we decided to finally bite the bullet and export out to Australia.

With Open Banking set to go live at the end of this year, exporting to Australia felt like a natural fit for us at tomato pay (formerly known as Fractal). The response we’ve received from many of the large banks, and challenger banks have been overwhelming. We were thrilled to get such a positive response from such a diverse market.

That’s why we are excited to be graduating from two prestigious accelerators - the UK, Australia Fintech Bridge organised by the Department of International Trade (DIT) and Startup Bootcamp Melbourne.

Nicholas Heller, tomato pay CEO commented: "We're excited to begin our journey in Australia this year, and start shaking up the financial services ecosystem that has deeply underserved small businesses for decades".

tomato pay CPO, Gaurav Katyal will be pitching alongside some brilliant startups at the renowned Forum Melbourne for Startupbootcamp's Demo Day.

You can watch Fractal pitch at the Startupbootcamp Demo Day live at 2:30 pm AEST, August 29th, here.

You can see the full video here.

You can see Startup Bootcamp's press release here, and on their blog here.

You can see the coverage of the Demo Day (including tomato pay - formerly Fractal) at Finextra, TechinAsia, Finder AU and Startup Soda.

You can watch us speak at Intersekt (October 14th - 18th), where we will also be graduating from the UK, Australia Fintech Bridge.

You can read our blog covering our trip to Australia last year with the Department of International Trade.

You can see our press release about joining the Australia, UK Fintech Bridge, earlier this year.

Community has never been as important as it is today, and watching the business and sole trader community struggle throughout the past year has spurred us on to take a more community-led approach to our business.

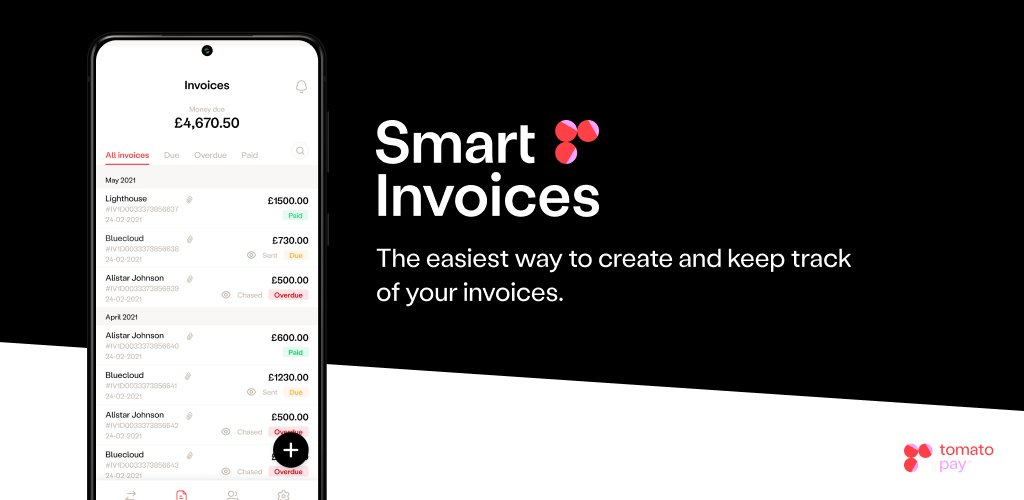

tomato pay is a simple, QR-code based payments and invoice app powered by Open Banking and built on our tomato pay API platform which offers both AIS and PIS capabilities.

Businesses and sole traders can benefit from our low-cost QR-code payments solution with no hidden fees, which saves them money compared to their current payment systems, gives them instant access to their money as cash settlement happens almost immediately, and access to all of their bank accounts in one place.

Businesses and sole traders can benefit from our quick and easy invoice solution. Invoices can be created within the app, with the option to give discounts and late penalties (pre-built into the app using gamification and behavioural science) and send nudges to remind customers and clients to pay. Plus, as you connect your bank account, payments are embedded within the app - so no need to give your bank details, and receive money owed instantly into your account.

Everyone can support their local communities thrive by paying their neighbourhood businesses in a cashless, hassle-free way.

.png)

.png)