We've launched! Our payments app is now live on the App Store and Google Play.

Plus we were featured in the national and trade press (which you can see here) on the topic of tomato pay, how we're helping communities and why QR codes is the new face of alternative payments.

We've come a long way over the last 12 months, and for many reasons, this is a monumental time in tomato pay's life as we launch the company's flagship app built off of our API suite.

The product itself is a simple QR-code based app that gives businesses instant cash settlement, lower payment fees and the ability to connect multiple bank accounts. Business owners can see their cash positioning and request and send money from customers without asking for bank details.

After our BCR Capability and Innovation fund win in September 2020, we were constantly asked about how we were going to support businesses, considering how much they have struggled over the last 18 months.

While SMEs still need financial products and services created specifically for them, the landscape has changed dramatically, which means the way we need to support them has changed too.

The answer to us was clear - late payments have continued to plague businesses by disrupting cash flow that may have already been planned for months ahead. This causes huge and sometimes potentially catastrophic consequences for businesses. According to the FSB, SMEs in the UK are owed a collective £23.4 billion; 62% have suffered from an increase in late payments as a result of the pandemic.

Since the pandemic hit early last year, we knew that small-to-medium-sized businesses would need more support than they were already receiving despite the tremendous government initiatives put into place.

Even pre-2020, the finance industry was only just waking up to the situation at hand - small-to-medium-sized businesses have always, and continue to be treated as inferior a financial institution's larger clients and consumer customers, therefore, they were serviced incorrectly, inefficiently, and were largely forgotten about as a whole.

Despite the huge contributions from these types of businesses to the UK economy (£2.3trillion to the UK economy to be exact), financial institutions had no idea on how to serve them, or how to give them the tools or finance they need to continue to run or grow.

Over the last few years, it has always been our mission to support SMEs, and we're ecstatic to see the launch of the tomato pay payments app and continue our work on building up communities by providing a low-cost payments alternative.

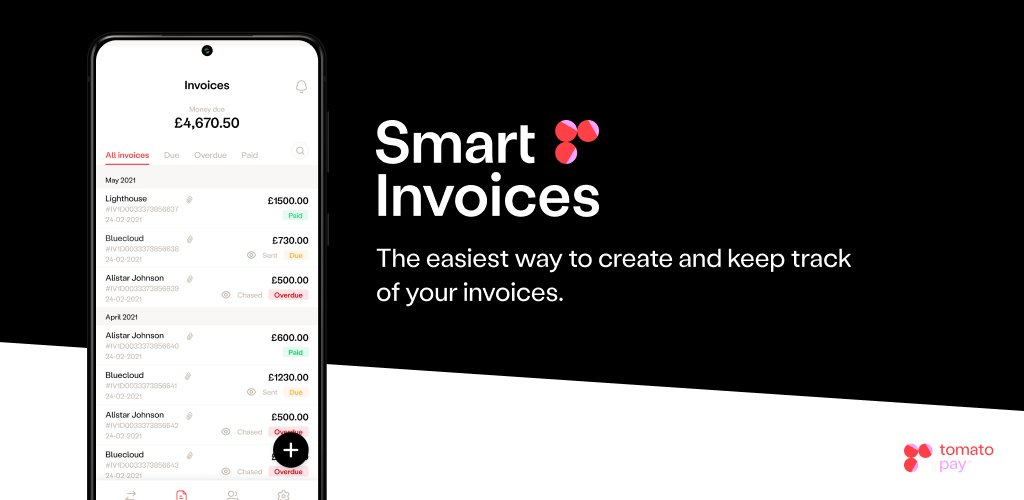

Over the coming months, we will be releasing our invoice solution on both the App Store and Google Play, and announcing a huge partnership with one of the UK's biggest banks - we're excited for you all to come along on this journey with us.

If you're a business or consumer, download the app from the App Store or Google Play, and share your feedback - we'd love to hear it all, good or bad.

Community has never been as important as it is today, and watching the business and sole trader community struggle throughout the pandemic has spurred us on to take a more community-led approach to our business.

tomato pay is a simple, QR-code based payments and invoice app powered by Open Banking and built on our tomato pay API platform which offers both AIS and PIS capabilities.

Businesses and sole traders can benefit from our cost-effective QR-code payments solution with no hidden fees, which can save them money compared to their current payment systems, gives them instant access to their money as cash settlement happens almost immediately, and access to all of their bank accounts in one place.

Businesses and sole traders can benefit from our quick and easy invoice solution. Invoices can be created within the app, with the option to give discounts and late penalties (pre-built into the app using gamification and behavioural science) and send nudges to remind customers and clients to pay. Plus, as you connect your bank account, payments are embedded within the app - so no need to give your bank details, and receive money owed instantly into your account.

Everyone can support their local communities thrive by paying their neighbourhood businesses in a cashless, hassle-free way.

tomato pay is an FCA-regulated authorised Account Information & Payment Initiation Service Providers (AISP/PISP) provider. You can find us on the Open Banking Directory, and on the FCA registered list here.

.png)