Last year, we had the pleasure of joining TMT Analysis for their roundtable focusing on mobile fraud. tomato pay (formerly Fractal) CEO and co-founder, Nicholas Heller was a part of the group selected to join the roundtable, which included Cifas, One World Identity, Kalgera, Hubuc and OpenPayd.

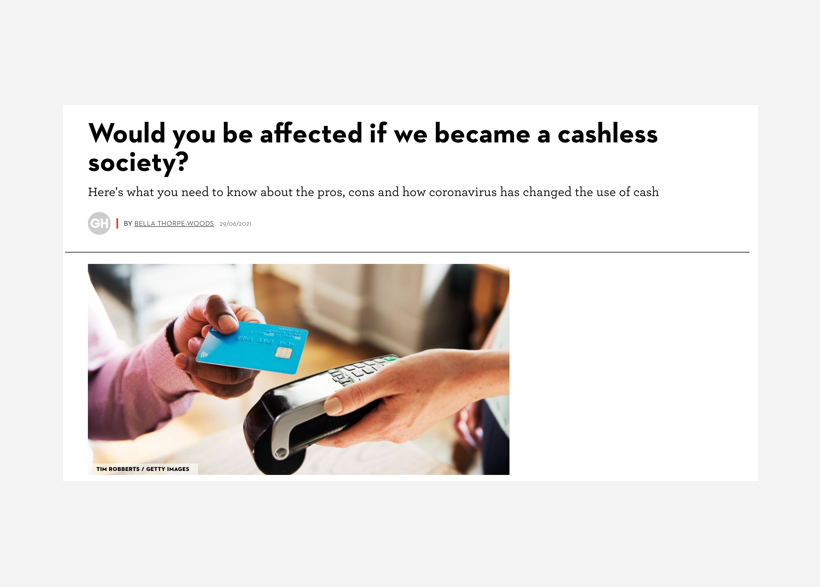

Pushing mobile-first products to scale-up, grow customer base and generate revenue is, in many ways, a double-edged sword. Reducing user friction and improving customer experience is critical to driving user engagement and growing revenue but it opens the door for multiple types of fraud.

Fraud is a challenge many of us will face, as those looking to take advantage of others become more sophisticated. Those of us, building products and services, need to constantly think about what living in a technologically-advanced world means for mobile banking. We need to be vigilant as the fintechs and creators behind many mobile-based financial services.

Fintech Futures stated in their roundup of the event: “Fractal Labs reminded everyone at the roundtable of the application of the Second Payment Services Directive (PSD2) and the Strong Customer Authentication (SCA) requirement, highlighting the future of biometric data providing greater security too”.

You can see more on our thoughts around Strong Customer Authentication (SCA) over at our blog, and our processes put in place so that we adhere to a high standard of security when working with financial institutions, and small businesses. You can find out more over ay our Security Page.

Community has never been as important as it is today, and watching the business and sole trader community struggle throughout the past year has spurred us on to take a more community-led approach to our business.

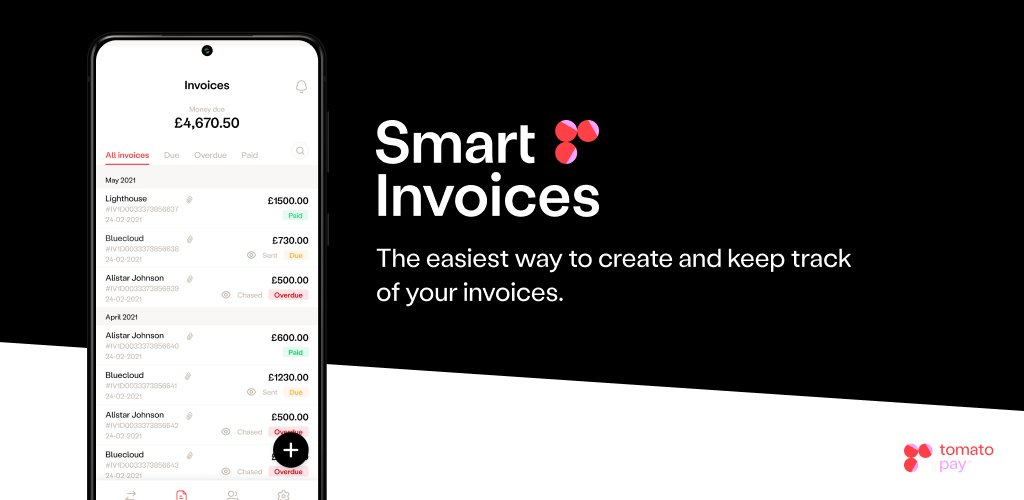

tomato pay is a simple, QR-code based payments and invoice app powered by Open Banking and built on our tomato pay API platform which offers both AIS and PIS capabilities.

Businesses and sole traders can benefit from our low-cost QR-code payments solution with no hidden fees, which saves them money compared to their current payment systems, gives them instant access to their money as cash settlement happens almost immediately, and access to all of their bank accounts in one place.

Businesses and sole traders can benefit from our quick and easy invoice solution. Invoices can be created within the app, with the option to give discounts and late penalties (pre-built into the app using gamification and behavioural science) and send nudges to remind customers and clients to pay. Plus, as you connect your bank account, payments are embedded within the app - so no need to give your bank details, and receive money owed instantly into your account.

Everyone can support their local communities thrive by paying their neighbourhood businesses in a cashless, hassle-free way.

.png)