We are excited to join this year's RBI 2020 EU conference to discuss API strategies

UPDATE - 25th March 2020: Link to the panel can be found here.

Nicholas Heller, tomato pay (formerly Fractal) CEO and co-founder: "Where I think data becomes more interesting is when you use it for credit risk modelling and the analysis on top of the data. The other element that we're really at the cusp of - our Payments API. If you take a user-focused approach, businesses suffer from late payments, costing the UK economy £2.5billion. What we're starting to see is interesting commercial models using payments API to address an SME's needs."

Due to the extraordinary times we are living in, we are delighted at RBI's decision to turn it into a virtual conference to protect the community, and in turn the population.

This year's topic on 'Developing an API strategy' is one close to our hearts here at tomato pay. We believe it is the best strategy forward to help financial institutions better support their small business customers, and give them the products and services they want and need.

The brilliant panel will consist of:- Nicholas Heller, CEO and co-founder, tomato pay

- Marco Tedone, Chief Architect IT, HSBC

- Chris Michael, Head of Technology, Open Banking Implementation Entity

We're excited to record our discussion, and for everyone to see it on Wednesday 25th March at 2pm.

For more information, you can visit RBI's website.

Community has never been as important as it is today, and watching the business and sole trader community struggle throughout the past year has spurred us on to take a more community-led approach to our business.

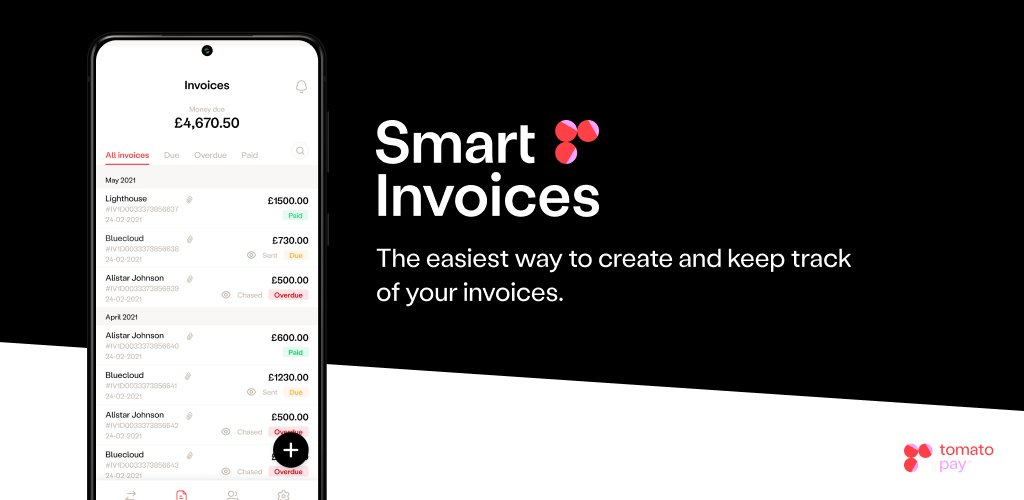

tomato pay is a simple, QR-code based payments and invoice app powered by Open Banking and built on our tomato pay API platform which offers both AIS and PIS capabilities.

Businesses and sole traders can benefit from our low-cost QR-code payments solution with no hidden fees, which saves them money compared to their current payment systems, gives them instant access to their money as cash settlement happens almost immediately, and access to all of their bank accounts in one place.

Businesses and sole traders can benefit from our quick and easy invoice solution. Invoices can be created within the app, with the option to give discounts and late penalties (pre-built into the app using gamification and behavioural science) and send nudges to remind customers and clients to pay. Plus, as you connect your bank account, payments are embedded within the app - so no need to give your bank details, and receive money owed instantly into your account.

Everyone can support their local communities thrive by paying their neighbourhood businesses in a cashless, hassle-free way. Join the waitlist.

.png)