We're so thrilled to be partnering with untied, a personal tax app, to create SMART (SMEs Manage Accounts Receivables and Tax) as part of our bid for the £2.5million, and £5million pots in the BCR Capability and Innovation Fund.

We were so happy to receive press from trade publications AltFi, Fintech Finance and Finextra covering our bid, and to get messages of support (here, here, here, here, and here) from those in the fintech community.

We believe that the money should be distributed to fintechs on the ground who can support small businesses (in particular sole traders) immediately.

Nicholas Heller, tomato pay (formerly Fractal) CEO and co-founder said: “Sole traders are working hard to overcome the many hurdles thrown at them caused by the current economic and health crisis. Many have had to turn to external funding that they otherwise would not have considered, and have to work with finance providers who are not well equipped to help micro-businesses. Sole traders desperately need the right support to overcome their everyday challenges, notably revenue management, the highly discussed pain point - understanding cash flow - payables and tax payments.

The BCR Capability and Innovation fund money would accelerate our effort to help these businesses in their greatest time of need. We believe the grant would be best dispersed to fintechs on the ground who can empathise with and immediately support small businesses with the tools they require. Larger businesses will, of course, find the money useful, however, we believe Pool E money would be best used by fintechs who are themselves SMEs.”

Kevin Sefton, untied CEO said: “Taxes are an important part of cash management. They’re particularly complex for sole traders. COVID support has helped many businesses and has highlighted the need for accurate and timely reporting. The SMART initiative is transformational - we don’t just allow taxes to be estimated, but do full calculations and submit filings as well. Its powerful automation saves entrepreneurs time, money and worries, freeing them to get on with stuff that matters to them.

We’ve had a longstanding relationship with Fractal. We believe strongly in partnership - SMART shows how innovative fintechs can combine world-leading expertise to help the nation’s SMEs.”

An overview of our bid:

- The initiative is focused on sole traders, who represent the greatest number of businesses in the UK of which 4.5m of the 5.9m small businesses in total, have no employees. They are key drivers to the UK economy.

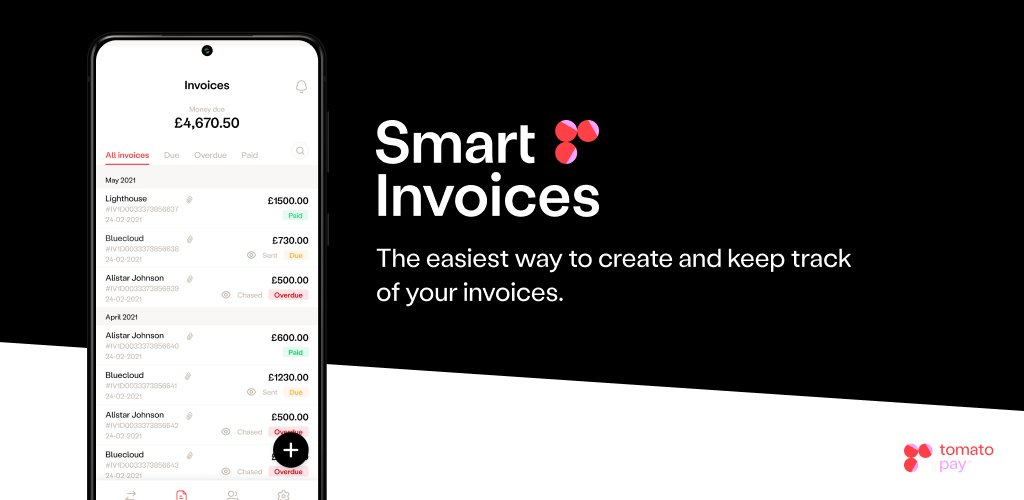

- The tool will help sole traders easily invoice customers, and track and incentivise payment through discounts and penalties.

- FSB states that small businesses are owed on average £6,142, and as a consequence of not being paid on time, 37% experience cash flow difficulties and 30% have been forced to use an overdraft.

- SMART integrates cash flow management by anticipating costs, specifically tax payments. untied reports that 51% of their own users from a sample set of platform workers do not know their own HMRC login which would normally prevent them from submitting their own tax return.*

- Fractal and untied estimate that by 2025, SMART will decrease average outstanding debt to SMEs by 29%, saving the UK economy £1 billion per year.

You can find the full press release here, a blog post on why helping sole traders with this challenge is critical to the success of the UK economy here, and untied's blog post on sole traders here.

To find out more about the initiative, our partnership with untied or if you are interested in partnering with us to create new SME-focused solutions, you can contact us at partner@tomatopay.co.uk

.png)